The Biden administration unveiled proposed regulations with the aim of reshaping the production landscape for electric vehicle (EV) batteries and their powering materials within the United States.

Curbing China from EV Tax Credits

This strategic move seeks to reduce China's dominance in this critical industry, as reported by Electrek. The regulations specifically target the involvement of Chinese firms in supplying materials for EVs eligible for federal tax credits.

Additionally, companies seeking federal funding to establish battery factories in the U.S. will face discouragement from sourcing materials from China or Russia. The objective is to stimulate changes in automotive supply chains, fostering a shift away from heavy reliance on China for EV components.

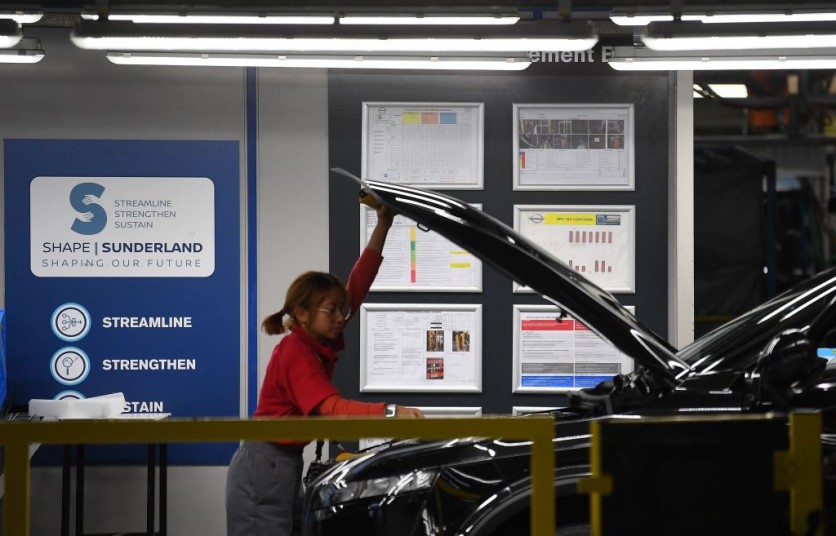

Automakers, under pressure to adapt their factories for EV production, often turn to China for advanced yet cost-effective battery technology. The Biden administration's push involves substantial federal funding to establish a robust U.S. supply chain for electric vehicles.

In 2022, President Biden signed a climate law offering consumers up to $7,500 in tax credits for purchasing electric vehicles (EVs) manufactured in the U.S. with predominantly domestic materials.

Designed to promote domestic production, CBS News reported that the law also imposed a blanket ban on products from China, Russia, North Korea, and Iran, preventing these countries' firms from supplying certain materials to tax-credit-eligible cars.

However, uncertainties persisted, especially regarding the definition of a Chinese or Russian company. Administration officials clarified that these entities encompass those incorporated or headquartered in China or Russia, as well as firms where the Chinese or Russian governments hold 25 percent of board seats or equity interest.

Chinese companies operating outside China may still benefit from the rules, provided the Chinese government isn't a significant shareholder. This provision relieved automakers, alleviating concerns that the Biden administration might restrict their engagement with Chinese-owned facilities globally, including those in the US.

Facing Opposition

Ford Motor's decision to license technology from the Chinese battery giant CATL for a facility in Marshall, Mich., faced opposition from some conservative lawmakers. They contended that partnerships of this nature should be ineligible for federal tax credits, expressing concerns about dependency on China.

On Friday, The New York Times reported that certain Republican lawmakers expressed dissatisfaction, asserting that the guidance from the Treasury Department falls short of reducing the country's reliance on China.

Representative Mike Gallagher of Wisconsin, the Chairman of the House Select Committee on the Chinese Communist Party, criticized the new regulations, suggesting that they could potentially channel American tax dollars to Chinese companies engaged in trade violations and forced labor abuses.

Related Article : IRS Lists Only 6 Electric Vehicles to Still Qualify for Full $7,500 Federal Tax Credit