Nitin Sharma is distinguished Solution Architect and Data Analyst, boasting over two decades of experience in BFSI.

UPI is an instant real-time payment system developed by National Payments Corporation of India (NPCI) innovative which facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions. It allows users to instantly transfer funds between bank accounts using their mobile phones. UPI lets users link their bank accounts to a unique virtual payment address (VPA). It offers several benefits like real-time transactions, user-friendliness, interoperability, cost-effectiveness, promoting financial inclusion.

Although the USA has similar payment systems like Zelle, Venmo, but each has its limitations. Therefore, there is tremendous potential in the USA adopting UPI. Drawing from his research, he presents a case for USA to embrace UPI.

UNIFIED PAYMENTS INTERFACE (UPI):

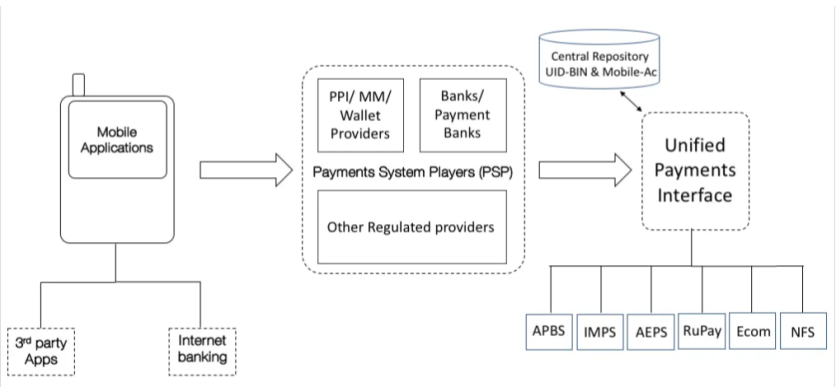

The UPI is an architecture built with intent to become a cashless society, which has majority electronic payments.

The UPI system developed primarily for mobile phone users (migrating the bank to phone). UPI enables financial inclusion of mass. If transactions can be made with the 1-click, then more people will use UPI.

The UPI uses existing payment systems like the Immediate Payment Services (IMPS), Aadhar Enabled Payments Service (AEPS) etc., to ensure the integrity of the transactions. This interface offers instant payment using the mobile phone.

Here are major compelling reasons why adopting UPI in the USA could be transformative:

1. Reducing Transaction/Credit Card Processing Fees

According to Nitin's research, indicates a pivotal advantage of integrating the UPI system in the USA.

I. Reduced Transaction Fees: UPI systems typically involve No/Low transactions vs credit cards.

II. Streamlined Payment Processes: UPI systems offer a fast way of processing payments.

III. Support for Small Enterprises: UPI infrastructure will foster favorable environment for small businesses.

IV. Inclusivity for Marginalized Communities: By alleviating the burden of processing fees, the government can contribute to inclusive economic landscape.

V. Competitiveness: Improved profitability allows business to reinvest.

2. Combating Tax Evasion

Having analyzed the challenges posed by tax evasion (globally), he firmly believes that adopting the UPI system can play a critical role in mitigating this issue.

I. Digital Trail and Transparency: Transparency will help authorities identify potential tax evasion activities.

II. Improved Tax Compliance: This digital record will enable the government to detect discrepancies and identify non-compliant.

III. Increased Tax Revenue Collection: Government's ability to collect taxes will improve.

IV. Streamlined Tax Filing Process: By leveraging digital data tax filing/ refund can be automated.

V. Equitable Tax System: When everyone pays their fair share of taxes.

3. Economic Inclusiveness

Here are some potential benefits of such an initiative:

I. Financial Inclusion: UPI can provide access to formal financial services for unbanked /under banked.

II. Reduced Cash Dependency: Cashless payment ecosystem will reduce physical currency.

III. Targeted Support and Aid: A digital payment system can help identify vulnerable and enable targeted interventions.

IV. Enhanced Transparency: UPI-based transactions offer transparency, making it easier to monitor financial activities.

V. Stimulating Economic Growth: By increasing financial access and reducing costs it can facilitate entrepreneurship.

VI. Improved Government Efficiency: UPI can streamline welfare payments and reduce leakages.

VII. Fostering Innovation: An advanced digital payment ecosystem can foster innovation in FinTech.

4. Reduced Need to Print Small Currency

His research findings illuminate the substantial expenses associated with physical currency production and distribution using UPI can also enhance national security and safeguard against illicit financial activities and fake currency.

5. Fraud Control

The security around each real-time transaction minimizes the opportunity for fraud, reducing risks and costs.

i. Virtual Payment Address (VPA): The VPA acts as a unique identifier for each UPI account. Eliminating need for sensitive information.

ii. Personal Identification Number (PIN): UPI user sets up a unique PIN associated with their account.

iii. Mobile Phone Association: Every UPI account is linked to a mobile phone through its IMEI number.

Conclusion:

From the perspective of FinTech specialist, the adoption of UPI in USA offers a myriad of advantages that extend beyond just enhanced revenue streams and tangible economic benefits, it offers a chance to promote social justice, economic inclusiveness, and transparency.

By curbing tax evasion, reducing transaction fees, fostering economic inclusiveness, and realizing cost savings, the USA can pave the way for a more resilient and equitable financial landscape. Embracing UPI embodies the spirit of progress and innovation.

Hence, as a FinTech specialist, He wholeheartedly advocate for embracing this innovative payment system, recognizing its potential to uplift communities, empower the underprivileged, and establish a more equitable and compassionate nation.