In these uncertain and volatile markets, AmeriStar stands out as a beacon of innovation and reliability, offering fixed-income investors a distinctive High Yield Certificates of Deposit (HYCD) program that can yield up to 12.73% APY with minimal risk.

What is this program, and how can investors safely generate double-digit returns?

Combining High Yield with FDIC Insurance

At the heart of AmeriStar's program lies a compelling financial innovation.

By combining a standard Certificate of Deposit that yields 3-6% interest depending on its maturity and an SEC Regulation D 506© Private Offering that produces between 5-7% annual returns, AmeriStar produces a lucrative and low-risk investment solution.

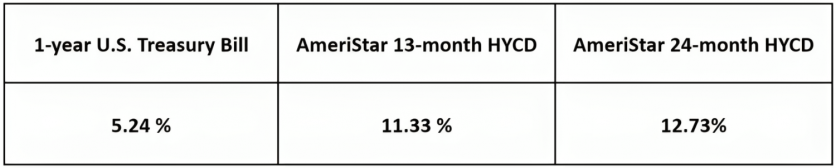

For example, its 13-month HYCD is currently yielding 11.33%, compared to a 1-year Treasury Bill's yield of 5.24%. For investors looking to lock in the highest rate possible, the 24-month HYCD is presently listed at 12.73% APY.

To put AmeriStar's 13-month HYCD's return into perspective, consider that the iShares MSCI World ETF—the benchmark for global stock performance—generated an average annual return of 9.89% since its creation in 2012. The iShares Core U.S. Aggregate Bond ETF—which tracks the overall performance of the American government and corporate bond market—generated a paltry average annual return of 1.09% over the last ten years.

However, contrary to equities and bonds, AmeriStar's HYCD program is not subject to any market volatility and also benefits from FDIC insurance, which makes the investment virtually risk-free.

In dissecting the comparative analysis, it becomes apparent that AmeriStar's HYCD program not only provides a secure investment avenue but also augments returns, making it a preferred choice for investors seeking a balanced blend of safety and profitability.

How to Generate Risk-Free High Yield

How does AmeriStar manage to offer double-digit returns?

The answer is simple: by charging a fee to help borrowers access credit.

In many instances, a borrower can't provide sufficient guarantees to secure a bank loan. Thus, the bank asks the borrower to find a partner who can help them to bolster their application.

That's where AmeriStar comes in.

By making a 'Courtesy Deposit' on behalf of the borrower to increase the bank's balance, AmeriStar provides the bank with the guarantee required to approve the loan. In exchange for this service, the borrower pays AmeriStar a 7% fee.

By combining the Certificate of Deposit's 4-6% yield with the 5-7% fee paid for the Courtesy Deposit, Ameritrade is able to package a High Yield, dual investment income stream for its investors. It is important to note that this return is entirely non-dependent on the borrower receiving a loan or financing because the 7% fee is paid before any Courtesy Deposit is made. AmeriStar only makes the Courtesy Deposit once the fee has been paid by the borrower.

Additionally, AmeriStar opens multiple bank accounts when the investment amount is over $250,000.00 to ensure that all of its investments always benefit from FDIC insurance.

A Market Rife with Opportunity

Some investors prioritize security.

AmeriStar's HYCD program addresses this concern with a robust security framework.

The unique aspect of utilizing investor funds to purchase a Certificate of Deposit only after the 7% courtesy deposit fee is collected ensures a secure and transparent investment environment. This strategy not only safeguards investor interests but also fosters trust in the program's operational integrity.

Further fortifying AmeriStar's position is the revelation that its courtesy deposit borrower list is well oversubscribed. Indeed, the tight monetary conditions have created a generational opportunity.

Since millions of Americans are struggling to get bank loans, AmeriStar has already secured enough qualified borrowers to meet demand until 2025. This fact underscores the stability and sustained interest in this innovative program.

Investors can take solace in knowing that AmeriStar has strategically managed its borrower portfolio, providing a buffer against uncertainties in the market and ensuring a consistent income stream.

Investing Made Easy

Another key attraction of AmeriStar's HYCD program is the ease with which investors can onboard and start investing. Opening an account with AmeriStar is quick and painless, reflecting the company's commitment to providing accessible and efficient financial services.

Moreover, AmeriStar's user-friendly platform offers a streamlined experience, making account setup and investment management a seamless process. This accessibility aligns with the broader trend in the financial industry, where Financial Technology companies (FinTechs) prioritize user-centric interfaces, making sophisticated investment opportunities accessible to a wider audience.

FinTechs: A Paradigm Shift in Financial Services

The success of AmeriStar's HYCD program serves as a testament to the evolving dynamics of the financial landscape, where FinTechs are disrupting and redefining industry norms. The agility, innovation, and specialization inherent in FinTechs distinguish them from traditional banking models, where rigidity and inefficiencies are commonplace.

In the context of AmeriStar, the HYCD program showcases how FinTechs can offer investors a dynamic alternative to conventional banking products. The program's adaptability to market changes, coupled with its targeted and specialized approach, underscores the fundamental differences between FinTechs and traditional banks.

While traditional banks may offer a comprehensive suite of financial services, innovative companies like AmeriStar excel in honing in on specific needs, providing investors with tailored solutions that reflect the dynamism of the modern financial ecosystem.

A Holistic Investment Choice

AmeriStar's HYCD program emerges as a holistic investment choice, offering a nuanced blend of security, profitability, and accessibility. The detailed comparison with Treasury Bills, the emphasis on security measures, the oversubscribed courtesy deposit list, and the user-friendly investment platform collectively position AmeriStar as a formidable player in the financial sector.

Investors seeking a diversified and innovative approach to wealth accumulation would do well to consider the unique advantages presented by AmeriStar's HYCD program. As financial landscapes continue to evolve, AmeriStar stands at the forefront, epitomizing the convergence of security, innovation, and user-centricity in the realm of FinTech-driven financial solutions.