CFPB released a new report to warn consumers about the risks of using payment apps, such as PayPal.

As of writing, more and more consumers tend to conduct bank transactions online. Well, this is easier than visiting the nearest bank and waiting in long queues.

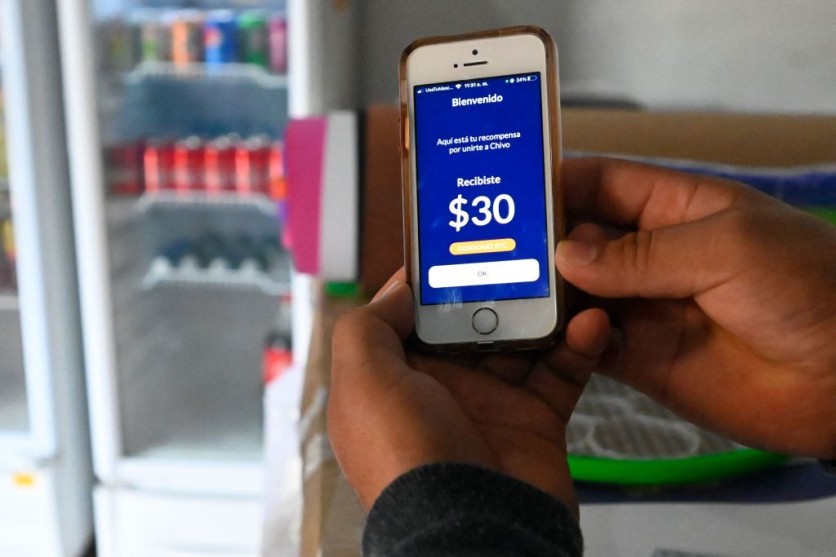

As this life scenario continues, PayPal, Venmo, Cash App, and other payment applications are able to attract more users.

If you are one of them, then you might want to think twice before using them frequently.

CFPB Warns About Dangers of Using PayPal, Other Payment Apps

According to CNET's latest report, the Consumer Financial Protection Bureau released a report to show the potential risks of using payment apps.

The agency mentioned the recent downfalls of numerous financial institutions, such as the Silicon Valley Bank, First Republic Bank, and Signature Bank.

"Popular digital payment apps are increasingly used as substitutes for a traditional bank or credit union account but lack the same protections to ensure that funds are safe," said CFPB.

The CFPB added that these financial apps could also use the money you put in them to invest without the same regulatory oversight as credit unions and insured banks.

Risks of Payment Apps

Via its official report, CFPB listed the risks of using payment applications. These include the following:

- When consumers store their money on payment apps, their funds are used for investments since they are not automatically sent to users' linked credit unions or bank accounts.

- Payment apps commonly don't have deposit insurance. Because of this, the investments done by these applications are very risky.

- The agreement information provided by PayPal and other payment apps is usually lacking specific details. This can put consumers at risk if ever they go bankrupt.

These highlighted risks can drastically affect many users, especially since payment app users are increasing. CFPB stated that transactions in these payment apps reached over $890 billion in 2022.

Here are other stories we recently wrote about financial risks:

TSB Bank previously warned about the rising get-rich-quick scams. Meanwhile, the Bank of America said that scam bank investment texts are targeting iPhone and Android users.

For more news updates about payment apps, always keep your tabs open here at TechTimes.