Everyone deserves equal access to financial security. After all, financial security plays a vital role in ensuring the safety and protection of you, your loved ones, and your personal belongings, even in the time of an accident or someone's demise. You can secure a better future by getting insurance that caters to your specific needs and the people, items, and properties that you value the most in life.

There are different types of insurance, each with its own set of benefits, such as life insurance, health insurance, property insurance, and auto insurance. But with Lemonade, you can get multiple insurance coverages in the most convenient way.

Features and Benefits of Lemonade

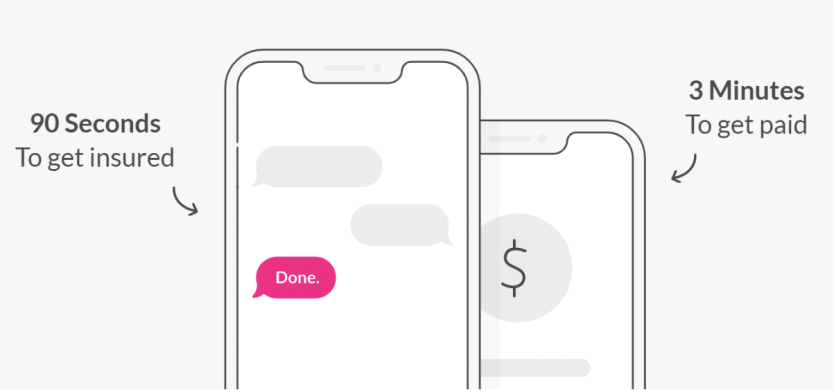

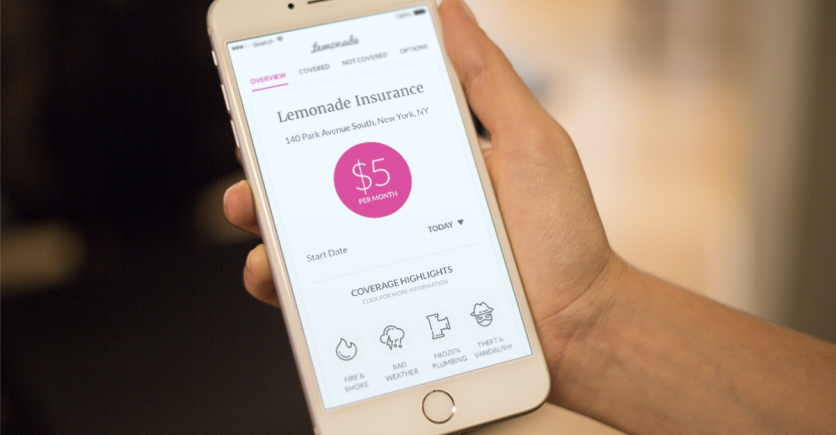

Lemonade wants insurance to be accessible for everyone, so you don't have to deal with confusing policies, stressful processes, or tons of documents. In just 90 seconds, you can get insured anywhere and anytime through their app. A chatbot named Maya will guide you in understanding the process. Then, the ideal insurance will be crafted for you instantly.

All you have to do is answer a few questions so they can determine your needs. It's like having a simple conversation with a real person-no complicated questions. After analyzing your data, Maya will show you personalized policies and prices curated just for you. You may also customize and adjust your coverage and pay without any hassle. Then you're all set! The entire process can be done conveniently on your phone or computer.

Another feature you'll feel relieved about is the very smooth filing, and handling, of claims. Instead of filling out forms and going throughlengthy procedures, Lemonade allows you to file a claim via chat and send videos to discuss what was stolen from you or damaged on your property. A chatbot named Jim will address your concerns and walk you through the process. Upon filing your complaint, you will be compensated in just a few minutes for the loss or damages.

What Makes Lemonade's Insurance Coverage Different?

Lemonade offers five hassle-free insurances that will secure your future and the safety and protection of the people and things you love. Their Homeowners Insurance covers your home and property from natural disasters, extreme weather, crime, and vandalism. It also protects you against liability claims for damages you may accidentally cause others, such as if your visitor gets injured, and when you cut down a tree in your yard and it falls on your neighbor's property.

In case your home becomes unlivable, Lemonade will cover the extra costs of your alternative living arrangements to lessen the burden for you. You may add Extra Coverage for your fine art, jewelry, watches, gadgets, bikes, musical instruments, and other expensive items as well. Additionally, Extra Coverage comes with deductible-free claims, accidental damage coverage, and mysterious loss coverage.

Lemonade's Renters Insurance is similar to the company's Homeowners Insurance. The coverage includes the damages and loss inside and outside your home or property, expensive items, and medical expenses if someone gets injured or encounters an accident in your home. Lability coverage also protects you against lawsuits when accidents happen in your home. A lawyer will be given to you to defend you and cover the costs.

For Lemonade's term Life Insurance offering, you have available term options of 10, 15, 20, 25, and 30 years. Lemonade's offering helps protect your beneficiaries with death benefits of up to $1,500,000. You can name your spouse (or ex-spouse), domestic partner, parents, kids, business partner, fiance or fiancee, sibling, or grandparent as your beneficiary.

People between 18 and 60 years old can apply. However, you may not be eligible for coverage if you have a history of heart disease, cancer, or other life-threatening conditions. This life insurance doesn't require a medical exam, which means you can apply online and if approved, can activate coverage today.

Lemonade allows you to protect your car and the environment with its Car Insurance. It covers damages to your car caused by accidents, vandalism, extreme weather, fire, falling objects, and other disasters. Lemonade also gets you covered if someone without insurance hits your car, if your car is stolen, and if you need roadside assistance (which is free if you drive with the Lemonade app). This will make it less expensive and stressful for you to deal with unpredicted incidents.

In order to be kinder to the environment Lemonade is planting trees based on their drivers' carbon emissions. EV and hybrid drivers also get discounts and special coverages for helping to reduce carbon dioxide emissions. The coverage includes emergency charging if you drain your battery, and charger coverage if something happens to your wall or portable charger.

Ensure the safety of your furbabies, too! Lemonade's Pet Health Insurance covers medical expenses related to accidents, illnesses, and treatments. Lemonade also offers preventative care packages, which cover non-emergency and routine medical care for your pet.

You may also get a preventative care package designed especially for puppies and kittens, covering necessary procedures, such as spaying or neutering, microchipping, flea medication, and up to six vaccines or boosters.

The Importance of Insurance

As a certified B corporation, Lemonade's commitment to making the world a better place is reflected in its business model. Lemonade offers a Giveback in their policies, withup to 40 percent of unclaimed funds donated to policies that Lemonade customers choose. Lemonade sums up the unclaimed money left from you and others who select your cause once a year. They also take only a flat fee from your premium payment and treat the money as yours.

Some people may not see the importance of getting insurance. In reality, however, investing in stable financial well-being can make your life much easier. Whether you're starting a new business or building your own family, insurance can help you protect your wealth, maintain your standard of living, make difficult times more manageable, and achieve peace of mind.