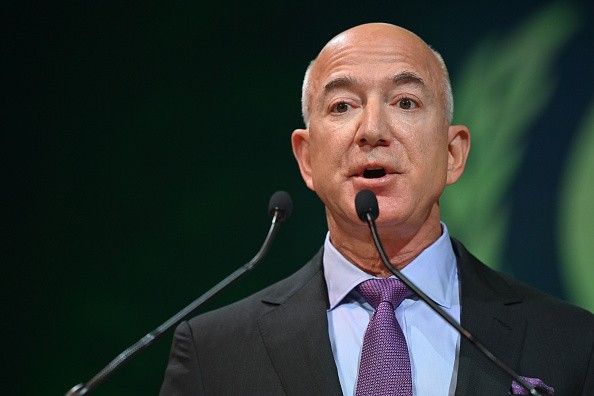

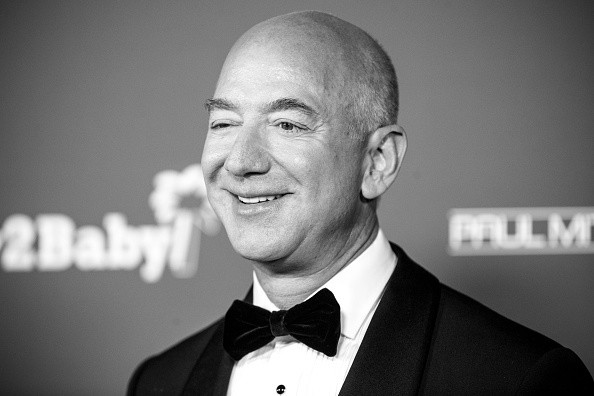

Amazon CEO Jeff Bezos is not happy with U.S. President Joe Biden's suggestion regarding the inflation rate.

This is because the American leader said that the inflation rate would go down if the richest individuals were paying their taxes fairly.

Because of this, Bezos provided his opinion regarding Biden's statement.

The newly created Disinformation Board should review this tweet, or maybe they need to form a new Non Sequitur Board instead. Raising corp taxes is fine to discuss. Taming inflation is critical to discuss. Mushing them together is just misdirection. https://t.co/ye4XiNNc2v

— Jeff Bezos (@JeffBezos) May 14, 2022

"Raising corp taxes is fine to discuss. Taming inflation is critical to discuss. Mushing them together is just misdirection," said the Amazon CEO via his official Twitter post.

Amazon CEO Jeff Bezos Bashes Biden's Suggestion

According to Geek Wire's latest report, Biden explained that taxing Amazon and other large corporations can help reduce the rising inflation rate.

But, Bezos disagrees with this. His latest rebut regarding the suggestion of POTUS is quite unusual since he is not really vocal when it comes to criticizing the U.S. administration.

This is not the first time that Joe Biden mentioned Amazon. In 2019, he included Amazon in the 91 Fortune 500 companies not settling their federal income tax.

For the past few years, many people have agreed with the idea of taxing the rich. However, is it really beneficial to increase their taxes?

Here are the pros and cons of taxing the richest people.

Taxing the Rich: Pros and Cons

SoapBoxie reported that there are pros and cons when it comes to taxing the richest people.

Cons

- More taxes means that companies and other organizations will have more reasons to generate more revenue.

- Tax raises can slow down the economy and lead to market stagnation.

- Critics explained that increasing the taxes of the rich will lead to the worst social division.

Pros

- Taxing the richest people can provide more budget to different sectors, such as defense, health, education, social security, and more.

- More programs for the poor can be created.

- Economic growth can also occur. This is already experienced by other countries, such as Australia, Canada, and Sweden.

If you want to see more details about the pros and cons of taxing the rich, you can visit this link.

Previously, Jack Dorsey said that he would not be reinstated as Twitter's CEO.

On the other hand, Twitter CEO Parag Agrawal explained why employees are being laid off.

For more news updates about Jeff Bezos and other popular tech CEOs, always keep your tabs open here at TechTimes.

Related Article : Jeff Bezos, Marc Andreesen Respond to Elon Musk's Tweet About Turning Twitter HQ into a Homeless Shelter

This article is owned by TechTimes

Written by: Griffin Davis

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.