Today, businesses and professionals recognize the power of accounting software in handling complex financial processes. Some systems offer the basics like sending invoices, tracking payments, and generating reports in preparation for tax season. The best digital accounting solutions improve efficiency through automation and intuitive interfaces so users can focus on strategic initiatives rather than balancing books.

Accounting software contains the tools for organizing, tracking, and reporting financial data to keep the records organized and well-managed. It can automate repetitive tasks like data entry and calculation for faster reconciliation. The digital accounting solution improves cash flow management as it streamlines financial operations.

Businesses suffer from a lack of accounting accuracy. Discover five of the best accounting software in 2024 to keep financial records organized and up-to-date.

#1 FreshBooks

Overview

#1 FreshBooks

Overview

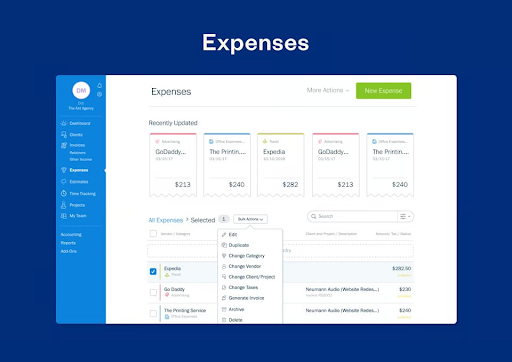

FreshBooks is cloud-based software that is built for small business owners and accountants. At its core, FreshBooks is designed to simplify accounting and financial management, allowing owners to focus on what they do best – grow their business. With a focus on ease of use, automation, and powerful features, FreshBooks helps businesses streamline their accounting and financial operations. From invoicing to project management, FreshBooks is designed to be intuitive and user-friendly, making it a popular choice among entrepreneurs and teams who need reliable accounting software without complexity.

FreshBooks Plans

FreshBooks offers four flexible subscription plans designed to cater to different business needs: Lite, Plus, Premium, and Select. The Lite plan is perfect for freelancers or solo entrepreneurs, allowing them to send unlimited invoices, track time, and manage up to 5 clients. The Plus plan expands on this with additional features like team collaboration, project tracking, and support for up to 50 clients, making it ideal for growing small businesses. The Premium plan is designed for larger teams, and has more advanced features such as the ability to manage unlimited clients, and enhanced reporting and workflows. For businesses with more complex needs, the Select plan offers custom pricing and enterprise-level features, including dedicated account support and personalized solutions. These tiered plans allow businesses to scale their FreshBooks usage as they grow.

FreshBooks makes it easy to access client details and manage bookkeeping with just one click. Designed with simplicity in mind, it's perfect for professionals who may not be tech-savvy but still want powerful tools to run their business smoothly. FreshBooks also offers dedicated support, client discounts, referral opportunities, and more to help owners grow their practice. And with award-winning customer support, FreshBooks provides a seamless and supportive experience every step of the way.

FreshBooks Features

Advanced Accounting Features

FreshBooks is a double-entry accounting application that makes financial management easier for small businesses and accountants. With tools to track income and expenses, generate detailed financial reports, and automatically calculate taxes, FreshBooks helps users stay organized and make informed decisions.

- Automated Financial Tracking: FreshBooks reduces manual work by automating transaction imports and categorizing them for quicker and easier income and expense management.

- Chart of Accounts: Users can turn on Advanced Accounting, which is recommended for accounting professionals or business owners with accounting experience. It allows users to create, edit, and archive accounts and customize account numbers and descriptions.

- Comprehensive Reporting: Users can generate detailed financial reports, including profit and loss statements and balance sheets, to get a clear view of their business's financial health.

- Seamless Tax Management: FreshBooks automatically calculates taxes and provides tools to make tax season preparation straightforward and stress-free.

For businesses that work with accountants, FreshBooks provides essential tools to work efficiently and collaboratively. Access real-time data and collaborate in a single source-of-truth platform to ensure compliant books and timely financial insights. Key initiatives to support accountant-client workflows include the introduction of Collaborative Accounting™, which enhances the advisory capabilities of accountants, and the Accountant Hub, which streamlines client management and bookkeeping. FreshBooks also offers an Accounting Partner Program fostering a vibrant community and support for accountants' professional growth.

Invoicing and Payments

FreshBooks offers digital billing and invoicing with a built-in invoice generator that creates professional-looking invoices and allows users to add tracked time and expenses. The accounting software can automatically follow up with clients, sending reminders or charging late fees, so users can focus on higher-priority tasks. FreshBooks also helps users get paid upfront, providing essential working capital to cover immediate costs.

FreshBooks Payments offers diverse payment options and leverages Stripe's latest technology for an intuitive, and client-centric payment solution. This seamlessly integrates billing, payment acceptance, and accounting, so business owners can confidently manage their operations. With FreshBooks Payments, clients can pay through multiple payment methods like credit cards, debit cards, and Apple Pay. The platform keeps owners up-to-date with automated notifications and logs of each transaction. Users can also offer clients flexible payment options to accommodate their needs like partial payments and payment schedules.

Teams & Projects Value

Whether it's for teams of 2 or groups of 10 or more, FreshBooks empowers owners, teams, and accountants to streamline client work and business operations. From managing projects and running payroll to organizing books and preparing for tax time, FreshBooks provides the essential tools including time tracking, proposals, estimates, and customizable roles and permissions for any business's team.

#2 QuickBooks

Overview

QuickBooks automates the key accounting processes from the general ledger to financial statements and reports. It auto-tracks transactions to keep users informed of where the money goes. The platform also contains powerful tools for digital accounting like real-time inventory updates and capturing receipts.

QuickBooks operates on the cloud and works on multiple devices so users can access financial information and collaborate with clients remotely. It uses industry-recognized security safeguards to secure data and maintain compliance. It also offers free user support to help accountants improve their digital accounting practice and provide better services to clients.

QuickBooks drives efficiency and saves time by automating accounting tasks. It gives real-time access to client files anytime, anywhere with one login to track all financial data. It also provides detailed insights through graphical reports. The accounting system also boasts an extensive optional app library that can supercharge the workflow and a mobile accounting app for tracking expenses on the go, even capturing receipts.

QuickBooks charges more for its subscription plans but it offers special discounts for accountants. The Plus plan can only accommodate five users, including the accountant, which can be disadvantageous for mid to large-scale businesses. The platform excels in account reconciliation thanks to its tracking capabilities and bank connections.

Features

Automatic Payment Reminders

QuickBooks ensures the invoices get paid with automatic payment reminders. The accounting system verifies the payments match the corresponding invoices, maintaining financial accuracy and transparency.

VAT and Expense Tracking

Accountants can get their clients ready for tax season and make the most of their deductions as QuickBooks organizes all expenses in one place and into tax categories. The accounting software also takes sales tax into account so clients know how much they owe during tax time.

Bank Connections

QuickBooks can provide a full picture of finances and transactions through bank connections. Connecting the accounting software to bank accounts can save clients time tracking cash flow and reconciling accounts.

Inventory Management

QuickBooks can help businesses keep up with customer demand by providing real-time inventory updates. Business owners can use the accounting software to run reports on best-selling items, total sales, and total taxes to understand stock trends and minimize oversells, stockouts, and markdowns.

Multi-currency Support

QuickBooks features multi-currency support so users can send invoices, record transactions, and adjust reports in different currencies. Businesses with an international customer base can assign currencies to various customers.

#3 AccountEdge

Overview

AccountEdge, a product of Priority, is full-featured accounting software catered for small-to-medium-sized businesses. It presents a simple but outdated-looking interface to help users run and report on all business aspects, from banking and sales to payroll and inventory. It also supports state and federal payroll tax tables and forms, helping businesses determine their tax liabilities with ease.

This accounting software may present a learning curve for non-tech proficient users. It complicates the setup due to the high amount of manual entries to be made for customization. Its subscription plans cost a bit higher than other digital accounting solutions but its Network Edition plan allows simultaneous company file access so multiple users can access financial records at any time.

Its AccountEdge Connect and Hosted may not appeal to small businesses as the price ranges from $15 to $50/user per month. Features like payroll and banks are also sold separately, which only increases costs for businesses with limited budgets.

Features

Time Billing

AccountEdge can track the work of each employee through time sheets or activity slips. Businesses can use the logged information when processing payroll. They can also set custom billing rates based on fixed or custom rates per activity so they can charge different rates based on the difficulty of the task or experience levels of the employee.

Data Management

AccountEdge can accommodate unlimited company files which users can manage easily. It provides a simple field mapping tool for importing/exporting transaction records, filters for searching any record, etc. It has integrated assistants to help users set up their company files and configure the features they use to create a custom workflow.

Contact Management

AccountEdge provides a customer portal where customers can view transactions and make easy secure payments. It can also display the client and vendor engagement history where users can see the last payments, highest balances, etc. These contact management features help businesses maintain good relations with leads, customers, employees, and other vendors.

#4 Xero

Overview

Xero presents a standard modern-looking interface for digital accounting. The platform organizes everything in one place and connects with other apps. It also imports bank transactions securely so users can see an up-to-date picture of the cash flow. Multiple users can collaborate in real-time as account owners can send invites and grant access controls.

Features

Accounting Dashboard

Xero provides an accounting dashboard where all account balances and reconciliations are visible. It contains tools that allow users to follow up on outstanding invoices like filters and summaries. It can also generate charts and graphs that show a wide range of business metrics which help users track business performance. The dashboard can also provide deeper insights like the tangible net worth and current liabilities so users can make informed decisions to improve the financial health of the business.

Automated Sales Tax

Powered by Avalara, Xero automatically calculates sales tax for any state or jurisdiction. The accounting software provides a fast, self-guided setup with detailed reports to help users prepare returns, making filing easier.

Asset Management

Businesses can use Xero can to track assets like vehicles, machinery, hardware, and office equipment. The accounting software automatically calculates the depreciation on these assets which can lead to substantial tax savings due to depreciation deductions. Account owners can set up the method and rate for the depreciation.

Project Tracking

Xero also contains tools for recording time and tracking costs. It has a built-in time tracker and location-based job tracker on mobile. These tools provide businesses with an accurate record of billable hours as they can see where project time is being spent and if the assigned jobs are profitable or overrunning the project. The accounting software also displays the staff time in the Project Staff report.

#5 Zoho Books

Overview

Zoho Books provides a secure location for managing accounting tasks and organizing transactions. It has a clean and simple dashboard that gives immediate insight into financial health. The accounting software also connects across multiple platforms. It has an effortless setup and import. The service offers a freemium version for businesses that earn less than 50K USD annually and subscription plans that range from 15 to 240 USD/per month.

Features

Projects Accounting

Businesses can use Zoho Books to optimize projects. It can generate a profitability report that helps users identify high-profit projects and optimize resource allocation, boosting sales and efficiency. The accounting software contains a timer to measure time spent which factors in the bill calculation, alongside total cost, tasks performed, and expenses incurred for the project.

Workflow Automation

Businesses can save time by automating high-volume tasks. Setting up triggers on Zoho Books reduces administrative tasks like converting quotes, creating bills from purchase orders, or sending payment reminders for overdue bills.

Comprehensive Reports

Businesses can make more informed decisions after understanding business performance from key business reports. Zoho Books contains 70+ built-in customizable reports that cover all business operations and provide insights.

Conclusion

From monitoring cash flow to automating invoices, using a robust accounting system assists businesses and professionals manage their financial transactions and record their accounting activities. It minimizes the risk of human error, resulting in more accurate financial statements and reports. Choose five of the best accounting software and overcome the drawbacks of traditional spreadsheets.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.