The energy industry repeatedly finds itself at the heart of major political debates and economic developments and often plays a crucial part in determining the pace and scale of progress on leading international priorities. Both in times of disruption and development, we rely on stable and affordable sources of energy to fuel growth and alleviate poverty. And as we now look to drastically reduce emissions and make progress on our climate goals, ensuring the sustainability of our energy supply is critical to achieving our net zero ambitions.

With such an integral role in the international system, and the unique ability to mobilise capital and drive innovation, the energy industry has assumed a greater responsibility than ever before. In response, policymakers and business leaders have taken important steps to enact real change in the industry—thanks to growing clean and low-carbon energy deployment, emissions are seeing a structural slowdown. Yet, despite continued efforts from both the private and public sectors, there is reason to believe the energy industry could be doing more to deliver tangible progress on leading energy challenges.

The question, therefore, remains: what is holding us back?

While the answer is undoubtedly multifaceted, my experience has shown that the energy industry often suffers from over-segmentation, where historic silos between energy-related sectors can hamper the free flow of ideas, capital, and innovation that is needed to maximise impact on key priorities. A byproduct of the industry's complex history and rapid growth, these silos create significant barriers to collaboration and cross-sector partnerships, both of which are critical to ensuring this industry can deliver on its mounting responsibilities.

The energy investment landscape offers one pertinent example of this dynamic. According to the World Energy Council, the energy transition requires over US$4 trillion in annual investment by 2030, yet current financial flows fall short by more than half. As a result, some 40% of energy companies globally are finding it increasingly difficult to secure reasonably priced finance for projects, causing delays in the scaling and deployment of clean energy technologies and decarbonisation solutions that can greatly improve the industry's ability to operate sustainably and efficiently. A driving force behind this severe lack of capital is the outdated nature of traditional financial models, which often view these projects as high-risk, particularly in developing regions.

Overcoming these antiquated models requires active cooperation between the private and public sectors, working together to identify the regulatory and incentive frameworks that can help de-risk investment in new low-carbon solutions, such as hydrogen and direct air capture. Thankfully, collaborative approaches to project financing are already emerging. Blended finance, for example, combines public and private investments to reduce risk and attract larger pools of capital. It has enjoyed a rapid rise to prominence as a financing strategy of choice for countries and companies around the globe. The task must now be to increase the use of such strategies through expanded private-public partnerships and re-evaluation of how we determine risk in this critical industry.

While eliminating these barriers to investment will undoubtedly improve the industry's ability to deliver sustainable and affordable energy for all, similar roadblocks have also limited the impact and integration of transformative digital technologies in the energy sector. Artificial intelligence (AI) and digitalisation offer tremendous potential to optimise energy efficiency, reduce costs, and accelerate the deployment of renewable energy. Recent studies have found that AI-driven analytics could reduce global energy consumption by as much as 15%, which would translate into savings of approximately US$500 billion annually (World Economic Forum). However, the energy sector has been slow to adopt these technologies at scale, primarily due to regulatory uncertainties and a lack of consistent collaboration between energy companies and tech innovators.

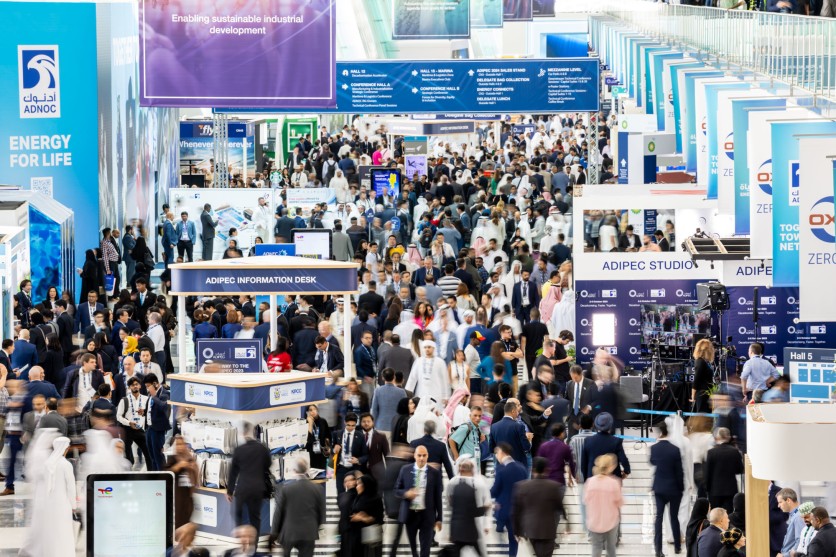

Having spent decades working in energy events, it is clear to me that the policymakers and business executives leading the energy industry recognise the pressing need to break historic siloes and enable greater cooperation across sector lines. Just a few short weeks ago, at our industry-leading energy conference ADIPEC, CEOs, and government leaders from around the world engaged in high-level debates on the future of our energy system. As a platform for the difficult and action-oriented conversations needed to ensure decisive energy action, we are seeing a continued commitment from across the value chain to accelerate change and create a more efficient, flexible, and sustainable energy future.

To move forward, the energy industry must make greater strides in turning words into action, dismantling these obstacles, and embracing a more integrated approach. The energy sector cannot afford to remain trapped in old paradigms, as the challenges we face—climate change, energy security, and economic inequality—are too complex for any one nation, company, or sector to tackle alone. At ADIPEC, the need for greater cooperation across sectors and borders once again took centre stage as industry leaders and policymakers worked together to unlock new opportunities for innovation, investment, and climate progress.

Christopher Hudson has more than 20 years of experience in the global events industry, including in launching and managing some of the energy sector's most prestigious and well-attended events. These include dmg's flagship energy events—ADIPEC, Gastech, Global Energy Transition Congress and Exhibition (GET), and the Japan Energy Summit and Exhibition, in addition to other major energy events across the world, in countries including the UAE, USA, Italy, Singapore, Japan and many more. Christopher works across the energy sector with public and private sector collaborators, including many of the world's leading national and international energy companies, industry service providers, national oil companies, and other key government bodies.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.