In a time of commoditization and stagnation for many advisors, Apex has emerged as a leader in helping professionals break free from traditional challenges.

The advisory world is buzzing about a new player that's quickly helped reshape the financial landscape: Apex Acquisition.

With whispers of transformation and industry insiders taking note, Apex is making waves by not just offering quick fixes but completely changing how financial advisors grow and manage their businesses.

In a time of commoditization and stagnation for many advisors, Apex has emerged as a leader in helping professionals break free from traditional challenges.

It's time to take a closer look at how they've managed to shift the game and become a critical partner in advisors' success stories.

Research shows that approximately 64% of financial advisors still rely on outdated marketing tactics, leading to a client conversion rate of only 2–5% on average.

With many high-net-worth clients expecting personalized service and data-driven insights, advisors who use broad, untargeted approaches often find themselves losing high-quality leads to competitors who prioritize precision and personalization.

Supporting Data:

- Stat: 64% of financial advisors use outdated marketing strategies. (Source: XYPN Network Survey, 2023)

- Stat: Average client conversion rates for traditional methods hover around 2–5%. (Source: Advisor Benchmarking, 2022)

Meet Nick Chopourian: The Visionary Behind Apex Acquisition

Nick Chopourian founded Apex Acquisition out of a deep understanding of the challenges financial advisors face.

Recognizing that many rely on outdated methods and struggle with either client overload or lack of clients, Nick envisioned a firm that would provide not just leads but comprehensive business transformation.

Under Nick's leadership, Apex emphasizes high-value client acquisition and operational efficiency, positioning itself as a vital resource for advisors who aspire to thrive in a saturated and struggling market.

Profile Overview

Founded by Nick Chopourian, Apex Acquisition is not just another marketing company—it's a transformative force in the financial advisory space.

While many firms struggle to grow and maintain client relationships, Apex helps advisors rethink every aspect of their business.

According to studies, advisors often look for external quick fixes like more leads or clients through quick-fix marketing strategies but miss the root causes of their stagnation.

They are battling commoditization and struggling to differentiate themselves in an increasingly crowded field.

The challenges they face extend beyond lead generation—they suffer from inefficiencies in client retention, inadequate processes, and a fundamental lack of clarity about how many clients they can reasonably serve without sacrificing service quality.

Measurable Success: Apex's Impact on the Advisory Landscape

Apex Acquisition's results speak volumes.

Advisors partnered with Apex have reported an average 200% increase in client acquisition and a 40% boost in retention rates within their first year.

This dual focus not only fills the pipeline with high-net-worth clients but also enhances client relationships and service quality due to extensive in-house training and one-on-one coaching.

By refining practices from the inside out, Apex has transformed how advisors operate, leading to sustainable growth and operational excellence.

Recent reports indicate that Apex Acquisition has been directly related to moving over $900 million in assets into the hands of advisors, with more than 450 advisors as existing clients.

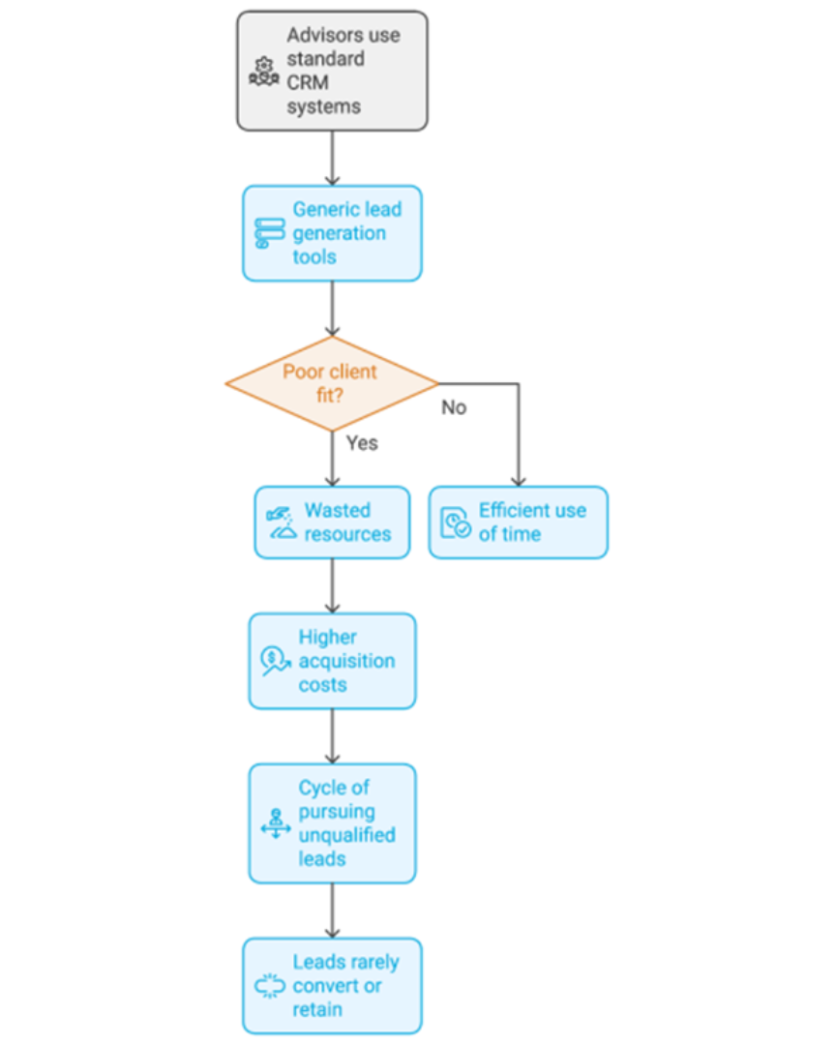

You see, according to studies, Advisors have often relied on standard CRM systems and generic lead generation tools.

However, this approach leads to two key issues: poor client fit and wasted resources.

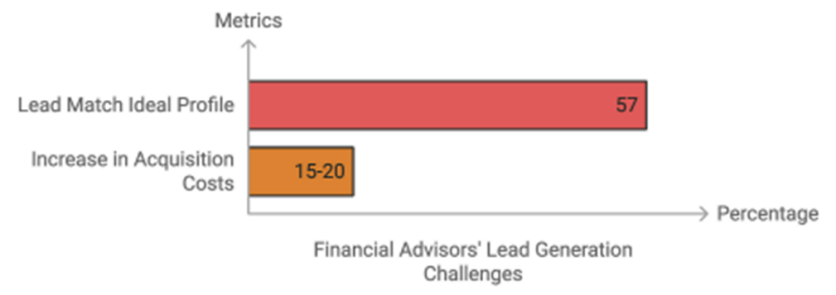

According to a survey by Financial Advisor Magazine, 57% of advisors report that less than half of their leads align well with their ideal client profile, leading to inefficient use of time and higher acquisition costs.

Without specialized targeting, many advisors find themselves stuck in a cycle of pursuing leads that rarely convert or don't retain long-term.

Supporting Data:

- Stat: 57% of advisors say less than half of their leads match their ideal client profile. (Source: Financial Advisor Magazine Survey, 2023)

- Stat: Advisors report an increase in acquisition costs by 15–20% when relying on generic lead generation tools. (Source: Kitces Research, 2022)

Achievements & Impact

Apex's approach sets them apart. Instead of just generating leads, they focus on transforming the entire advisory business model from the ground up.

Simply put, getting a calendar full of HNW prospects is the easy part.

This comprehensive process ensures that advisors can not only acquire clients but also improve client relationships, build stronger fulfillment teams, and develop better processes.

Nick and his team have been instrumental in revolutionizing how advisors view their practices.

By providing a proven system for generating appointments that consistently delivers high-quality leads, they remove the stress from the acquisition process.

But Apex doesn't stop there. Once the pipeline is flowing, they help advisors address deeper issues, from staffing and fulfillment to client success management and more.

Apex has generated results that speak for themselves, with advisors reporting significant business transformations and more efficient, scalable operations.

Admittedly, the ability to go beyond surface-level marketing is what has everyone talking.

As advisors struggle with growth, retention, and the looming "Dunbar's Theory"—which suggests that human relationships become ineffective after a certain number of clients—Apex steps in with strategies that allow advisors not only to survive but thrive.

Apex Acquisition brings a neuroscience-backed framework to client acquisition.

By focusing on psychological triggers and behavior-driven targeting, Apex helps advisors pre-qualify leads with a high likelihood of conversion and long-term retention.

Apex's proprietary framework has driven success rates over 25% higher than industry averages, and advisors using Apex have reported up to a 50% increase in appointment scheduling within their first three months.

Supporting Data:

- Stat: Advisors using neuroscience-backed acquisition frameworks see up to 25% higher conversion rates than those using traditional methods. (Source: Apex Case Studies, 2023)

- Stat: Apex clients report a 50% increase in appointment scheduling within the first three months of implementation. (Source: Apex Client Success Metrics, 2023)

Real Stories, Real Impact: Client Transformations

Through its innovative approach, Apex Acquisition has facilitated remarkable transformations for its clients.

For instance, one advisor noted a dramatic turnaround from erratic client acquisition strategies to a steady influx of high-net-worth clients, allowing for deeper engagement and relationship-building.

The client, who asked for anonymity, stated, "Apex caused more problems for me."

The source claimed he had grown so quickly that he had issues fulfilling, managing staff, and managing his team... A good problem to have?

Seems so...

Another advisor shared how Apex's streamlined systems alleviated management burdens, enabling him to double pipeline efficiency and focus on serving clients who aligned with his long-term goals.

These success stories illustrate Apex's profound impact on advisory practices.

Direct Comparison between Apex and Traditional Services

Let's put this into perspective.

Traditional lead generation methods typically yield a 2–5% conversion rate, whereas advisors using Apex's proprietary framework see average conversion rates closer to 12–15%.

Additionally, Apex clients report a reduction in client acquisition costs by up to 30%, thanks to targeted lead generation and fewer wasted interactions. These results aren't just numbers—they represent real growth that directly impacts an advisor's bottom line.

Supporting Data:

- Stat: Traditional methods yield 2–5% conversion; Apex clients see 12–15% conversion. (Source: Apex Client Success Metrics, 2023)

- Stat: Apex reduces acquisition costs by up to 30%. (Source: Apex Internal Research, 2023)

Looking Ahead: Apex's Commitment to Advisor Growth

Apex Acquisition is not just about immediate gains; it is dedicated to fostering long-term advisor development.

Nick envisions a future where Apex extends its proven model through workshops and certification programs, empowering more advisors to refine their practices and achieve sustainable growth.

By continuing to innovate and adapt, Apex remains a vital partner for advisors ready to navigate an evolving industry landscape.

Vision & Future Outlook

Apex is more than a marketing firm.

Their vision goes beyond immediate results—they aim for long-term transformation.

Nick has been vocal about his commitment to seeing advisors not just grow but prosper for years to come.

This stems from the personal relationships he has with the industry. Nick stated, "I was surrounded by close friends and family who were failed advisors who couldn't crack the code."

Looking at the industry as a challenge that he has no choice but to overcome.

The future for Apex Acquisition is about scaling this model to more advisors and showing the industry how powerful a complete business transformation can be.

Nick's outlook for the future includes providing advisors with continuing education and growth opportunities so they can stay ahead of industry changes and challenges.

From scaling up staff to refining operational processes, Apex has proven that it isn't just about helping advisors get clients—it's about helping them create sustainable, long-term success.

Words of Wisdom: Insights from Nick Chopourian and Advisors

Nick Chopourian emphasizes, "Our mission at Apex is to align advisors with clients who fit their vision for long-term success. It's not about filling a pipeline; it's about creating meaningful, high-value relationships that foster mutual growth."

A satisfied advisor remarked, "Apex has helped us rethink our entire practice. We're now focused on the right clients, and the results speak for themselves."

These insights highlight the transformative power of Apex's approach.

Overcoming Challenges: Lessons from the Field

Many advisors encounter significant challenges when adapting to new operational frameworks.

Apex Acquisition guides its clients through this transition, helping them shift their focus from merely increasing client volume to emphasizing the quality and alignment of client relationships.

Those who embrace this change not only find increased efficiency but also develop deeper, more rewarding client engagements.

Challenges & Lessons

Like any business, Apex has faced its own set of challenges, most notably convincing advisors to rethink the way they operate.

Many advisors are so entrenched in old ways of doing things that they're hesitant to embrace change. However, for those willing to make the shift, the rewards have been immense.

By offering solutions that address not just client acquisition but also fulfillment, staffing, and process optimization, Apex has helped advisors build more resilient and successful businesses.

Nick has emphasized the importance of focusing on high-net-worth clients to ensure advisors maximize their efforts.

In an industry where the number of clients often stretches beyond the capacity to provide high-quality service, Apex has been a beacon of clarity for advisors, showing them how to work smarter, not harder.

Join the Movement: Apex Acquisition and the Future of Advisory Success

As the advisory industry continues to evolve, Apex Acquisition stands at the forefront, guiding advisors toward sustainable success.

With a commitment to transformation and a proven track record, Apex invites advisors ready to rethink their practice and join the movement. Together, we can redefine the future of advisory services.