Are you confident in how your supply chain finances are managed? In the intricate world of supply chain dynamics, efficient financial processes are essential for seamless operations and maintaining strong supplier relationships.

Enter Billhop, a B2B solution transforming procurement by offering innovative ways to optimize cash flow and manage tail spend. Billhop allows businesses to pay suppliers using credit cards—even if those suppliers don't accept card payments directly. This enables businesses to streamline payments, extend payment terms, and manage working capital more effectively.

This article delves into strategic financial management, focusing on tail spend, supplier onboarding, and working capital optimization. Discover how Billhop can be a game-changer for procurement and finance professionals seeking a competitive edge.

The Challenges in Supply Chain Finance

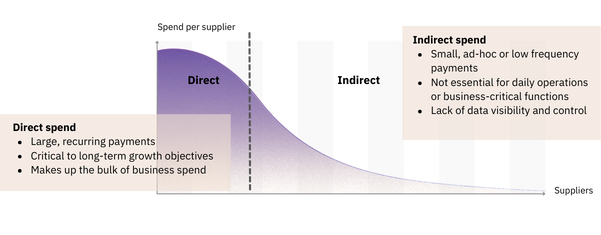

In today's complex business environment, supply chains involve intricate supplier networks that present significant challenges. While strategic suppliers—those critical to core operations—are usually managed efficiently and paid on time, issues frequently arise with non-strategic or one-off suppliers found in the "tail spend."

Tail Spend refers to the portion of a company's expenditures that is not strategically managed. It typically consists of numerous low-value transactions spread across many suppliers. Although individually small, collectively these expenses can represent a significant portion of total spend. Mismanagement in this area can undermine operational efficiency and strain supplier relationships.

The Importance of Efficient Tail Spend Management

Managing tail spend is challenging due to the high number of small or infrequent suppliers and the lengthy supplier onboarding processes, which can sometimes stretch out for months. These delays can stall transactions and increase administrative overhead.

Payment delays to non-strategic suppliers can also have adverse effects. For smaller suppliers, late payments can strain cash flow and financial stability, potentially disrupting their ability to deliver goods or services. Efficient and timely payments are essential to maintain good relationships and ensure uninterrupted operations.

Introducing Billhop: Streamlining Payments and Supplier Onboarding

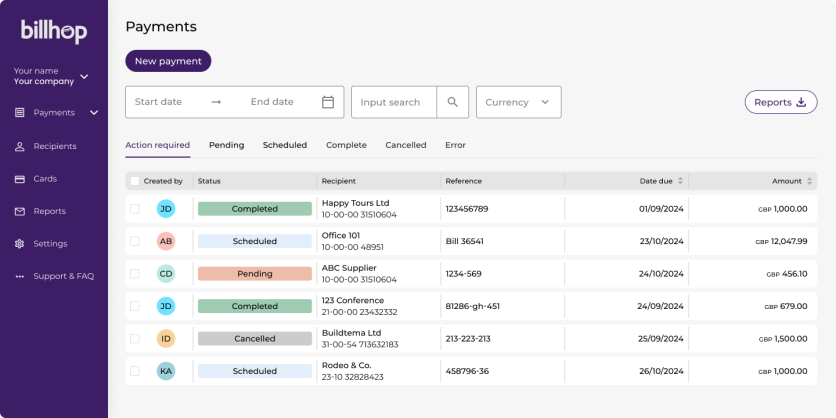

Billhop addresses these challenges by simplifying the payment process and eliminating the need for extensive supplier onboarding for tail-end suppliers. Here's how:

- Credit Card Payments to Any Supplier: Billhop allows businesses to pay any supplier using commercial credit cards, even if those suppliers don't accept card payments directly. Billhop processes the payment and transfers funds to the supplier's bank account, so the supplier doesn't need to change their payment preferences.

- No Supplier Onboarding Required: Billhop removes the necessity for lengthy supplier onboarding procedures, making it ideal for handling small, frequent purchases.

- Improved Cash Flow Management: By using Billhop, businesses can take advantage of credit card billing cycles to extend their payment terms without delaying payments to suppliers. This offers more flexibility in managing working capital.

- Access to Early Payment Discounts: By ensuring suppliers are paid promptly through Billhop, businesses can potentially unlock early payment discounts, leading to direct cost savings.

Embracing Innovation with Billhop

Efficient financial management is key to maintaining a competitive edge in supply chain operations. By leveraging innovative solutions like Billhop, businesses can optimize tail spend management, strengthen supplier relationships, and enhance working capital efficiency. Embracing such advancements positions your company for greater operational excellence and sustained growth in today's dynamic market.

Visit Billhop today to learn more and start simplifying your supplier payments.