Small businesses need a checking account that allows them to operate smoothly without unnecessary hassles. Bluevine Business Checking could be the right fit for some. Launched in 2013, this online banking platform offers a business checking account with unlimited transactions, minimal fees, and a range of other valuable features.

This review of Bluevine Business Checking explores all the benefits it offers to business owners and compares it to other available options, helping you determine if it's the best choice for your needs.

>> Bluevine Business Checking >>

Bluevine Review — Our Verdict

Bluevine bank is an easy and cost-effective option when compared to other business checking accounts available. The competitive interest rate it offers is beneficial for small companies, especially if they keep larger sums in their Bluevine Business Checking account, as most business current accounts either don't pay interest or are given a minor return.

This Bluevine review will show that Bluevine Bank doesn't have brick-and-mortar locations, which means that it's not the best choice for business owners who prefer to complete financial activities face-to-face. With all the convenient features like ATMs, cash deposits, and mobile access, you may never have to walk into a bank in person again.

The fee associated with depositing cash into a Green Dot Bank account could be a major obstacle for companies that often handle huge sums of money.

Bluevine bank supplies only a single business current account, so you may have to open accounts at other banking institutions to meet the diverse requirements of your firm. It's more comfortable to have all your banking needs taken care of by the same bank, and there could even be bonuses to your association with the bank if you do so.

Despite the effort required, the bonuses and lack of fees associated with Bluevine Business Checking could make it worthwhile.

Pros

- Establishes a fair rate of interest

- Funds placed in an account can be taken out without difficulty

- Extensive automated teller machine network

- An individual doesn't need to maintain a minimum amount of money when setting up an account

- There'll be no restrictions on how many times the transaction can be performed

- Permission to compose checks and two free checkbooks

- There are no consistent expenses and only a handful of additional costs

Cons

- Bluevine customer service is available from Monday to Friday only

- A charge for depositing cash is applicable

- There's no physical site for this branch

- No financial savings

- Mobile banking application has unfavorable Bluevine reviews

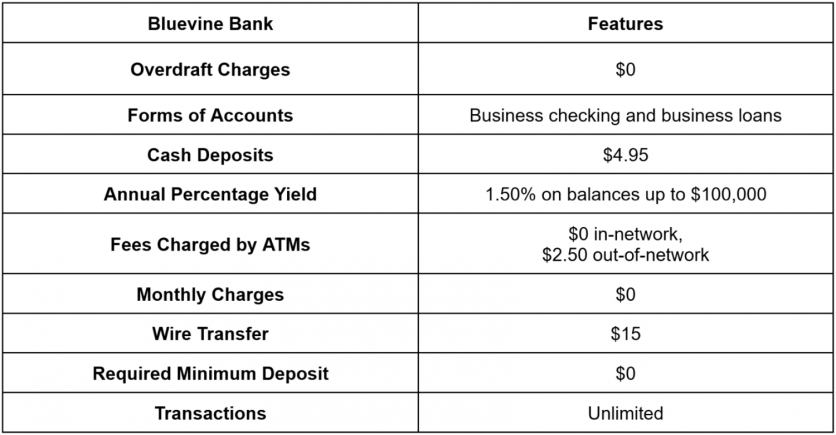

Bluevine Business Banking at a Glance

It's pretty common for web-based corporate accounts to be fee-free and enable unrestricted transactions each month. However, Bluevine exceeds expectations with its no-cost, high-yield Business Checking account.

Bluevine Bank offers a 2.00% annual interest rate on deposits up to $100,000 in its Business Checking account, which is one of the most attractive rates available. We'll explore the requirements to qualify for this rate further in our Bluevine review. Furthermore, Bluevine Business Checking account holders may deposit cash into their account, though there's a cost associated with this service, unlike other online banking accounts.

Bluevine Bank, a FinTech firm created in 2013, has recently started offering Bluevine Business Checking accounts. This banking service is provided by Coastal Community Bank and customers' deposits are covered up to $250,000 under FDIC insurance.

Who Bluevine Business Checking Is Best For

Companies that prioritize small overhead costs, the ability to perform an unrestricted number of transactions without having to pay extra and the possibility of earning interest on their extra money may think that Bluevine Business Checking is the perfect solution.

If your business doesn't usually deal with large amounts of cash and you don't need the standard banking services, Bluevine Business Checking could be a viable consideration.

This Bluevine Business Checking review recommends that small businesses that would gain the most from this service are those who:

- It's possible to complete business transactions without needing to go to a physical branch

- Are you in search of a business bank account that offers interest with no cost

- Rely heavily on the Internet for their monetary requirements

- One corporate bank card is enough

Bluevine Business Checking Fees

When companies are trying to operate at a profit, they must be mindful of every penny. With Bluevine Business Checking, there are no fees for monthly service or minimum balance requirements. There are plenty of advantages, such as:

- With the availability of more than 37,000 MoneyPass ATMs without any extra charges, you don't have to be concerned about any unexpected banking fees

- It's not required to make a specific minimum deposit

- There's no requirement to maintain a specific balance

- There's no limit to the number of transactions you can make using your Bluevine bank checking account

- There are no penalties for not having enough money

- No fee is imposed

If one takes out money using a Bluevine card at an ATM other than a MoneyPass one, which has an agreement with Bluevine, then they will charge an additional $2.50.

>> Check Out Bluevine Business Checking >>

Bluevine Business Checking Features

There's only one type of account available from Bluevine. The account offers a range of features, and if your balance in the Bluevine Business Checking account is between $0 and $100,000, you'll get a competitive 2.00% Annual Percentage Yield (APY). Interest isn't paid on amounts above $100,000.

To keep the 2.00% APY on the Bluevine Business Checking account, either $500 must be spent with the Bluevine Business Debit Mastercard every month or $2,500 in customer payments must be received by the company through wire transfers, ACH transfers, mobile check deposit, or vendor payment processing provider.

Vendor Services

In this segment of our evaluation of Bluevine, we'll discuss the various benefits associated with the Bluevine Business Checking account for making supplier payments simpler. As a proprietor of a small business, you have a broad spectrum of choices for paying vendors, including electronic fund transfers, wires, and paper checks.

For paying bills, you have the option of going through your Bluevine Business Checking account. It can either be a one-time payment or set up a routine payment. If you choose to establish a continuous payment, you'll be able to know the exact date when your payment will be received by the person who you're paying.

The Bluevine website already registers 40,000 vendors, but you can add your own. Their online payment system accepts credit card payments.

>> Open Bluevine Business Checking Account >>

Transactions

As we discussed earlier in our Bluevine Business Checking review, it's a web-based banking service, so there are no physical offices for customers to visit and talk to a banker. However, we've also discovered that customers can still use various other types of transactions due to their connection with other financial organizations.

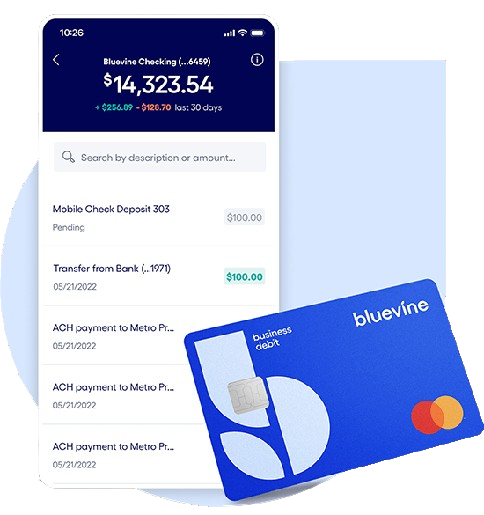

All Bluevine Business Checking accounts are packaged with a Bluevine Business Debit Mastercard and two complimentary checkbooks. Via a partnership with MoneyPass ATM, customers of Bluevine bank have access to over 38,000 ATMs throughout the US without incurring any fees.

In this Bluevine review, it's noted that they have a beneficial partnership with Green Dot. As a result, entrepreneurs don't have to stress over not being able to add cash to their accounts due to the lack of physical branches.

Approximately 90,000 stores across America accept money to be processed at the checkout. According to our in-depth Bluevine business checking review, one of the drawbacks of this service is a deposit fee. It's important to note that Green Dot's deposit charge could be up to $4.95. Green Dot might place daily limits on cash deposits.

Safety

Bluevine takes pride in being a financial technology firm rather than a traditional bank. Working together with Coastal Community Bank (Member FDIC), they offer financial services. Money that you place into your Bluevine Business Checking account at Coastal Community Bank is insured by the Federal Deposit Insurance Corporation (FDIC) up to the legal limit.

Mobile App

The Bluevine mobile application offers users the advantage of digital check deposits and the capacity to take care of numerous banking requirements. Through this program, company owners can monitor their cash flow and administer their Bluevine Business Checking accounts from any spot.

To find out more about the mobile app, look into the Bluevine business checking reviews for mobile app feedback.

>> Open Bluevine Business Checking Account >>

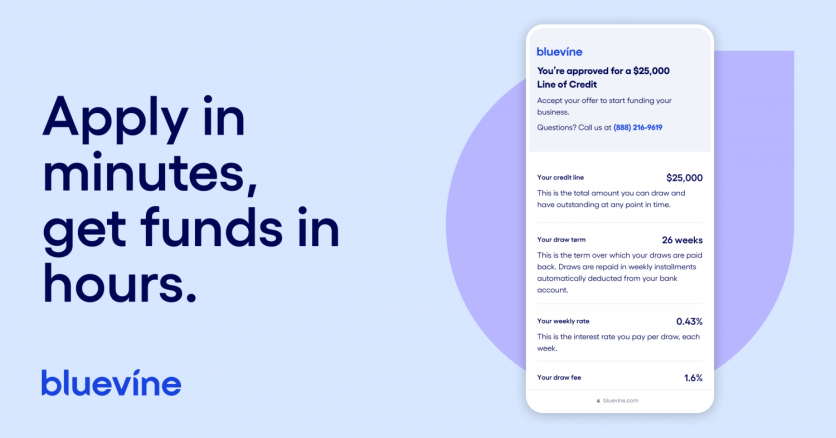

Business Loans

A company line of credit of up to $250,000 can be obtained to finance large purchases. Interest rates for business loans are as low as 4.8 percent, and the approval process may take only a few minutes, according to an evaluation of the Bluevine Business Checking service.

To be eligible for a loan from Bluevine, you must have a credit rating of 600, a monthly salary of no less than $10,000, and a business that has been set up or running for a minimum of half a year in the United States. After you offer some extra information and present your most recent bank statements, Bluevine should be able to make a lending decision.

If you're hoping to obtain a business loan but have a terrible credit rating, Bluevine Business Checking may not be the right fit for you.

How to Open a Bluevine Business Checking Account

Establishing a Bluevine Business Checking account is possible both online and through the mobile application. Entrepreneurs in all US states and the District of Columbia can use this service.

All who are applying must be 18 or older and a United States citizen or a legalized resident with a legitimate and permanent residential address in the US (not a P.O. Box). Certain activities are restricted due to these conditions.

What You Need to Open an Account

Establishing a Bluevine Business Checking account necessitates the submission of certain personal and business data. Depending on the type of business entity being created, applicants might have to provide additional documentation. This part of our Bluevine business checking review talks about the requirements you must fulfill.

- Paperwork: Depending on the type of business, certain paperwork may need to be completed, including articles of incorporation, certificates of formation, DBA filings, and partnership agreements.

- Business Information: This information may include the business name, its physical address, the type of organization it is, the contact number, and its gross revenue. Its primary industry, tax identification number, or Employer Identification Number (EIN) must also be included.

- Private Information: Private information includes an individual's name, family name, home address, cell phone number, date of birth, and social security number. Any shareholder with a 25% or more interest must provide the accompanying details.

Investigating for our Bluevine review, we found that applications for a Bluevine Business Checking account are typically assessed within three days of being sent in. Once they're approved, you can establish your account, buy your Bluevine bank debit card, and transfer funds.

>> Start Using Bluevine Account >>

How to Earn Interest with Bluevine Business Checking

If you reach one of the monthly caps, you can take advantage of the 2.00% annual percentage yield on your Bluevine Business Checking account, with a maximum of $100,000.

- It doesn't matter which method you choose to move $2,500 in customer payments into the Bluevine Business Checking account of the company, whether you prefer an ACH transfer, mobile check deposit, wire transfer, or direct deposit from a payment processor, all are acceptable.

- Utilize the Bluevine Business debit card to execute a buy of $500.

How to Access Your Money with the Bluevine Business Checking Account

For those who use a Bluevine Business Checking account, there are a few different choices for deposits and withdrawals.

Deposit Options

Four methods are available for customers to finance their Bluevine Business Checking account:

- Money may be moved into a Bluevine Business Checking account from another bank account by linking the two

- Deposit cash at any Green Dot retail store to use with your Bluevine Business Checking account (there'll be a fee associated with each deposit)

- Bluevine doesn't assess a fee for accepting wire transfers, but the sending financial institution almost certainly will

- Users of the Bluevine app may deposit checks using their smartphones

>> Open Bluevine Business Checking Account >>

Withdrawal Options

Funds can be deposited into the Bluevine Business Checking account as cash at a Green Dot ATM. Moreover, Bluevine Business Checking account holders have access to a business debit card which can withdraw money without cost from any of the more than 38,000 MoneyPass ATMs situated across the US.

A fee will be incurred if customers access an ATM outside of the network. Moreover, Bluevine Payments is a viable choice for transferring money directly to other individuals or businesses.

Is Bluevine Trustworthy

We had previously noted while examining the Bluevine Business Checking account that customers will be imposed a fee if they use an ATM that's not part of the network. Bluevine Payments can move money between individuals and companies.

Despite an A+ rating from the Better Business Bureau, it doesn't guarantee a satisfactory experience with Bluevine. If you're uncertain whether to use their services, it's wise to look up Bluevine reviews online or ask opinions from people you trust.

Alternatives to Bluevine Business Checking

If you have any lingering doubts after reading this Bluevine business checking review, let this Bluevine review provide you with some extra insight. The next section delves further into the other available options.

Novo

Just like Bluevine, Novo only offers business checking accounts, which makes it a formidable choice. After you register for the service, there are no extra costs or fees whatsoever.

You'll be paying a hefty fee of $27 for every overdraft, which is considerably more than the fee of $5 mentioned in our Bluevine review. However, there's no requirement to maintain a minimum balance, and the bank will cover your charges for utilizing any ATM.

Pros

- Refunds the entire expense of the automated teller machine

- There are no restrictions on the balance that needs to be maintained or any costs associated with maintaining an account each month

- A handheld program

Cons

- Unable to put money into a bank account

- A lack of savings accounts

- Overdraft

Lili

Lili takes it one step further by offering a free tax optimizer to make sure you don't pay too much or too little in taxes. You can be prepared for tax season without any surprises by setting aside money automatically. The program also helps organize your private and business expenses to make it easier to figure out what can be deducted.

Generally, signing up for Lili is free of charge, and there's no requirement to make a long-term commitment. However, larger businesses may have concerns about the amount of money that can be deposited or withdrawn. Unlike the experience described in our Bluevine review, it's not possible to send money through a wire transfer using Lili.

Lili offers a savings account that you can open with the purpose of having enough money to pay for something expensive. With the basic version of Lili, you'll not make any money off of the funds in the account.

Lili provides a savings account that can be opened with the intention of setting aside money for a large purchase. The standard version of Lili doesn't generate any interest from the money deposited in the account.

Pros

- Possessing the ability to save money for future utilization

- Formulating a strategy for minimizing taxes that are owed to the government

- Devising a plan to reduce the amount of taxes

Cons

- There's no charge for the use of the free account, and the interest rate is nil

- To access several of Lili's superior services, one must become a paying member

- It's not allowed to employ wire transfers

Axos

Unlike what was observed in the Bluevine Business Checking review, Axos allows you to open not just a company checking account but also a personal savings account or a savings account for your business.

There are no charges associated with establishing or managing a basic bank account with them, and you don't need to keep a certain amount of money in the account. This account will cover the expenses of using an ATM located abroad.

Companies can still benefit from a savings account even though the interest rate is quite low at 0.20%. To open a premium savings account, the initial deposit must be at least $25,000. However, the annual percentage yield stays the same no matter what amount is deposited.

It's a fact that Axos has prices that are quite ordinary. The rates for certificates of deposit (CDs) aren't particularly inviting at 0.20%. If desired, you have the option of utilizing Axos to open a checking account or a savings account for yourself.

Pros

- It's not necessary to maintain a certain amount of funds or pay a fee for a standard checking account

- It's possible to select different kinds of checking accounts

- Compensating all charges incurred when using an ATM within the country

Cons

- Certain bank accounts necessitate an initial deposit that's considerable in amount

- Corporations are receiving very low returns on their savings accounts

- Inadequate yields on certificates of deposit

Bluevine Business Banking Review — Frequently Asked Questions

To learn more about Bluevine Business Checking, check out the list of frequently asked questions. After reading this Bluevine review, if you still have queries, see if they're addressed in the FAQs.

Is Bluevine Legit?

"Yes" is the immediate answer. Bluevine is a tech company focusing on the banking sector. Celtic Bank, a Utah-chartered bank with FDIC insurance, provides its customers with the Bluevine credit line. A Bluevine Business Checking account is available via Coastal Community Bank. As per Crunchbase, which keeps tabs on startups, the private business has garnered $769.2 million in investment.

How Much Can I Withdraw from Bluevine?

The total limit for withdrawing cash from ATMs, getting a cash advance at the point of sale, or getting a cash advance over the counter is $2,000 per day. It's possible that retailers and partner banks might charge fees or reduce the amount of money that can be withdrawn. However, withdrawals from MoneyPass ATMs will not cost extra.

Is Bluevine FDIC Insured?

The total limit for withdrawing cash from ATMs, getting a cash advance at the point of sale, or getting a cash advance over the counter is $2,000 per day. It's possible that ATM operators, retailers, and partner banks might charge fees or reduce the amount of money that can be withdrawn. However, withdrawals from MoneyPass ATMs will not cost extra.

>> Start Using Bluevine Account >>

Bottom Line on Bluevine Business Banking

Bluevine Business Checking is an excellent option for small businesses, offering interest on balances up to $100,000 with minimal monthly fees. It also boasts the highest interest rate among all business checking accounts featured on Select's list.

>> Start Using Bluevine Account >>

Related Articles

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.