Building long-term wealth starts with managing your finances. You need to take into account all for your current income and expenses. including any paychecks, side hustles, or businesses and expenses that happen monthly, quarterly, or on special occassions. Tracking all of your transactions will help you keep your spending in check, not go over the budget, and still have money leftover for savings or emergencies.

Budgeting ensures you have enough resources to meet your goals. By planning your finances in advance, you can gradually work towards long-term goals without fear of overspending, like purchasing a home or an early retirement.

Also, creating a budget can help address your bad spending habits. It forces you to track your earnings and expenses so you can become more financially responsible. Get the help you need by using the best budgeting software for taking control of your finances.

Budgeting software breaks down your expenses into categories or areas of expenses so you can keep track of where your money is going. It keeps your finances organized so you can create and stick to a budget, track every dollar you have earned, and potentially help improve your financial health.

Some budgeting apps securely link to bank accounts, which helps you review transactions and reconcile costs. Many of these solutions provide mobile support, so you have the information on hand at all times to keep track of spending and save towards your financial goals.

Start managing your finances with the best budgeting software in 2024. Discover five of the best apps for building a budget and tracking expenses.

#1 CalendarBudget

Overview

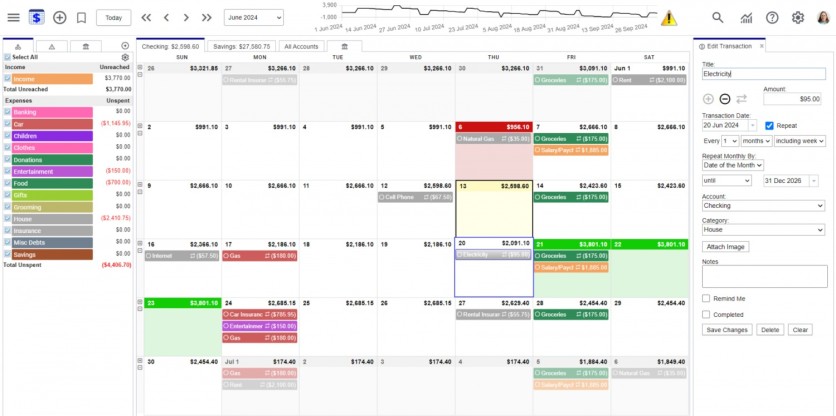

CalendarBudget helps you keep your daily transactions organized on a budget calendar with daily expected account balances that help you know if you are on track to achieving your financial goals. This budgeting software caters to busy individuals seeking a more comprehensive yet straightforward solution to budget management.

CalendarBudget empowers you to forecast your cash flows for months, even years ahead so that you can afford to not worry about your personal finances. The budgeting app visualizes the future of your account balances so you can make informed decisions, plan thoroughly, and adjust your spending habits according to your budget calendar.

The budget management software boasts capabilities that ensure you are always on top of your spending as it gives you insights into your spending patterns. Through scheduled reminders, categorizations, and other visual financial representations, CalendarBudget provides the financial clarity you need to achieve your long-term goals.

CalendarBudget offers a 30-day free trial and works seamlessly across all platforms and supports multiple currencies for only $7.99/month or $56.99/year.

Since its founding in 2007, CalendarBudget has stood out among its competitors with its innovative approach to forecasting cash flow. It leverages the calendar budget method to help users track and forecast their spending from any device.

The budgeting software caters to users of all financial literacy levels. CalendarBudget stands out for its unique forecasting feature, which can help anyone save more, repay their debts on time or ahead of schedule, and earn a newfound financial confidence to build long-term wealth.

Features

Calendar Budget Method

CalendarBudget removes the complexity of tracking and planning your money in the past and future through the calendar budget method. The budgeting app breaks down your income and expenses into a monthly calendar. You can set up your bank accounts as tabs at the top of the calendar so you can build a budget that aligns with their respective balances. You can easily drag and drop transactions to when they acutally happened or to when they need to be rescheduled.

The budget calendar shows your account activity, such as car payments, monthly subscriptions, gas, etc., with the amount for each entry. It also displays the end-of-day balance, which is automatically calculated based on how the amount of the day's entries affect the previous day's balance. CalendarBudget makes it easy to visualize your finances and identify areas where you need to reduce your spending using your daily balances, monthly high and low balances, category budgets, and reports.

Scheduled Reminders

CalendarBudget can send you reminders so you never miss paying bills and other upcoming transactions. Use the high or low balance highlighting to easily identify your highest and lowest balance for each month. These reminders and visual cues can help you become financially responsible as the app shows the downstream effects of existing and potential purchases.

Customizable Categories

CalendarBudget organizes your expenses into categories that you can customize. You can set a budget for each area of expense. The budgeting software automatically displays the remaining balance for each category, indicating whether you have overspent or stuck to your budget plan. All selected categories on the side panel get highlighted on the calendar so you can see at a glance where all your money is going.

Future Planning

You can plan your finances months or years ahead on CalendarBudget. Set your regular transactions to repeat into the future as you expect them to happen according to your spending patterns. Use the budget calendar's future planning abiity to set saving goals, pay off debt sooner, or make big purchases so you can see how much money you need to set aside to make the purchase while staying within your budget plan. The budget management software tracks and forecasts your money and visualizes it in the same way you spend it - day-by-day.

Multiplatform Support

CalendarBudget runs in your web browser and provides a dedicated mobile app available on Android and iOS devices. The budgeting app syncs every change made across devices, so whether you're organizing your budget calendar on your laptop or through your phone, you can always pick up where you left off and adjust when necessary.

Reasons to consider:

Ability to plan into the future

30-day free trial

Accessible on web browsers and smartphone devices

Bank connect and auto-import transactions ready to be reconciled

Ease of use

Automatic daily balance calculations

Automatic category budget calculations

Reasons to avoid:

The user interface looked dated at the time of review. However, the creators have since published a visual update that brings the interface to a modern look and feel.

#2 YNAB

Overview

YNAB (You Need a Budget) helps you create a flexible financial plan that is easy to follow. The budgeting app tells you how much you need to set aside based on your income/balance, expenses, and saving goals. It presents a modern, intuitive interface, ensuring seamless navigation so you have more control over your personal finances.

YNAB automatically tracks your spending, so you no longer have to tally up numbers in a confusing spreadsheet. It also has an integrated loan planner to help you demolish debt. The budgeting app aligns your spending with your priorities. It can break down costly purchases into manageable monthly chunks.

YNAB can also link to your bank accounts so you can see any transactions you have made through them. The app only factors in your current balance, so its calculations are accurate and trustworthy. Through auto-assign, it can automatically distribute your money into different areas of expenses, starting with your highest priority needs. You can easily redistribute the money allocated with a few taps.

YNAB offers a 34-day free trial and works on all devices. It supports multiple currencies and can be shared among six people for $14.99/month (monthly plan).

Features

Goal Tracking

YNAB can calculate how much you need to save each week, month, year, or by a custom date to help you reach your goal. You can set up targets on the budgeting app and see the progress you've made for them through color-coded progress bars. The app can remind you how much money you need to add to stay on track. You also have the option to snooze a target due to unforeseen circumstances.

Loan Calculator

YNAB contains a loan planner tool that calculates how much interest and time you willneed to save for every dollar you put toward debt. It provides paydown options based on your monthly payment, payoff date, and extra payments so you can allocate your resources without fear of compromising your credit score. You can earn points to claim rewards through its seamless system for credit card spending, which reassigns funds from a transaction's expense category to the credit card's payment category, which is beneficial if your account ever runs out of balance.

Budget Reports

YNAB can generate budget reports, which you can filter by category groups, timeframe, and accounts. You can review your expenses against your income and make informed decisions on how to budget more wisely. The budgeting software exposes your spending habits so you can make the necessary changes to keep your balance above zero.

Reasons to consider:

Long free trial

One subscription supports six users.

Customizable

Automatic distribution of money

Reasons to avoid:

Lack of bill paying features

#3 Monarch

Overview

Monarch centralizes all tools essential for financial management from budgeting and tracking goals to investments and transactions. It syncs with multiple financial data aggregators so you can monitor your bank accounts from one place, and even track real estate property values. This all-in-one money platform also leverages artificial intelligence to clean transactions and keep them organized for faster reconciliation.

Monarch also provides flexible budgeting tools and rollovers. Automatic notifications can help you stay on track. It caters to couples who work toward shared financial goals and advisors who need a single platform for managing client transactions. The budgeting software lets you collaborate with other users at no additional cost for only $8.33/month.

Features

Fully Customizable

You can create a fully custom budget unique to your needs. Monarch lets you modify groups, categories, and even emojis for labeling. You can also change the order of how things are displayed so you can see everything at a glance, as the budgeting software boasts a clean and intuitive interface that you can easily navigate.

Track Your Progress

Monarch can help you stay on track with your expenses as its budget view directly shows you how much balance you have left in your budget. You can see if you went over or followed your budget as the app shows the remaining balance for each category you created.

Plan for Big Expenses

You can plan for big expenses like holiday shopping purchases by scheduling them annually. Monarch prepares you so you can build a budget before you expend a huge amount of money. You can also test out different scenarios on the budgeting app and see how they impact the long-term view of your finances.

Collaboration Built-in

You can share access to your plan with your partner or other members of the family so they have a collective understanding of your finances. Monarch provides them with their own login so they can view your data and contribute their own accounts to your space, which keeps everything transparent among partners.

#4 Zeta

Overview

Zeta offers modern-day joint and personal bank accounts to help users manage their finances. This budgeting app can support bill payments and can automatically set aside money for bills with the option to pay via ACH, check, or card. It also boasts robust security with two-factor authentication and data encryption to keep your data secure. All funds in your account are FDIC-insured, which means your funds are federally protected against bank failure or theft.

Features

Instant Transfers

You can instantly transfer funds between your personal or joint accounts through Zeta Pay. Zeta also makes it easy to collect payments as you can request money from other people. The budgeting software gives free access to 55,000+ ATMs through its Allpoint network so you can withdraw money from the nearest ATM, which you can check in the Move Money section.

Bill Reserve

You can plan for your bills beforehand by setting funds aside for them. Zeta prevents you from overspending, so you still have the funds to pay for your bills. You can use the budgeting app to pay them via check, debit card, or ACH.

Spending Trackers

Utilize spending trackers to help you stay within budget. Zeta keeps you in check so you still have enough funds for the week or the month.

In-app Messaging

Communicate with your partner or your team through in-app messaging. Zeta cultivates transparency and connection among users who have joint accounts by letting them collaborate directly on the budgeting app.

Reasons to consider:

Supports bill payments

Credit card support

No monthly account fees

Reasons to avoid:

Less focused on budgeting

#5 Quicken Simplifi

Overview

Quicken Simplifi accommodates any budgeting method users prefer. It is an affordable budgeting software accessible through mobile and desktop platforms. It offers a personalized spending plan and syncs your bank accounts to show your current standing and progress on your goals. The app also keeps your personal information safe with 256-bit encryption.

Features

Personalized Spending Plan

Quicken Simpli provides a personalized spending plan based on your earnings and expenses. You don't have to conform to one style of budgeting. You can see at a glance where your money is going and how much income remains after bills and savings have been deducted from the current balance.

Fully Customizable Reports

You can derive insights on your finances from its automatic, fully customizable reports. The budgeting software presents the numbers clearly so you can understand your spending habits, track cash flow, and review other aspects of your finances.

Real-time Alerts

Quicken Simplifi sends alerts in real time whenever it notices unusual or unexpected transactions. It also notifies you whenever there are upcoming bills and subscriptions or when you're close to reaching your spending limit.

Reasons to consider:

Most affordable out of the five.

Secure and credible

The spending plan adjusts automatically.

Reasons to avoid:

Premium features exclusive to Classic and Deluxe products.

No free trial/version

Conclusion

Budgeting software puts you in control of your finances by making it easy to track your expenses and earnings. You can see exactly where your money goes as the app organizes it into categories that expose your spending habits, increasing your awareness to realize your goals for saving or paying off debt.

Managing your finances starts by having a clear understanding of your financial situation. Get the best budgeting software to help you realize your spending behavior and create a budget that aligns with your goals and meets your needs.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.