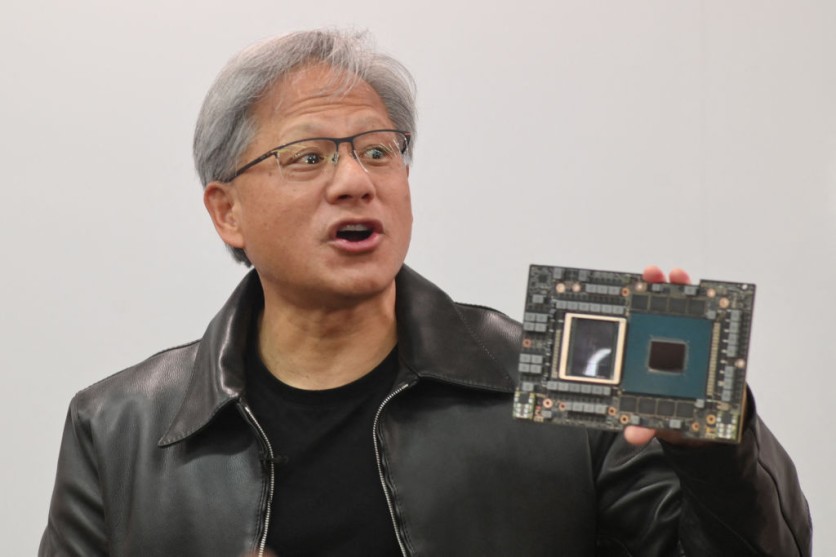

Nvidia is now looking at a yearly release timeframe for its new artificial intelligence chips. The confirmation comes after recent reports indicate a new AI chip is already on the way for Nvidia in 2025, just a year after the AI chip giant released the Blackwell.

The Verge reports that until now, Nvidia has released a new architecture every two years; examples of these releases are Ampere in 2020, Hopper in 2022, and Blackwell in 2024.

However, earlier this month, analyst Ming-Chi Kuo said that the next design, dubbed "Rubin," is expected to arrive in 2025, meaning we may see an R100 AI GPU as early as next year. Based on Huang's statements, it appears that the report may be accurate.

According to Huang, Nvidia would also quicken the production of all other chip types to match that cadence. During the call, Nvidia CEO Jensen Huang responded to an analyst's question about how the company's new Blackwell GPUs would ramp when Hopper GPU sales were still strong by stating that the company's AI GPUs are software- and mechanically backward-compatible.

According to the CEO, customers will have no trouble switching from H100 to H200 to B100 in their current data centers.

Read Also : Microsoft Looks to Remedy Nvidia H100's Constricted Supply With Alternative AMD AI Chips

Nvidia's Astounding Earnings Report

Nvidia's boost on AI chip release timeframes comes alongside the company's booming business in the AI chipmaking industry. Nvidia reported $26 billion in sales and $6.12 earnings per share for the three months ended April 30.

Sources claim that analysts had predicted adjusted EPS of $5.65 on $24.69 billion in revenue. Nvidia estimates $28 billion in revenue for the current quarter, give or take 2%.

That is more than the $26.6 billion forecast by economists. During the same period last year, the company made $1.09 in adjusted earnings per share (EPS) on $7.19 billion in revenue. Up to 4% was seen in Nvidia's shares during Wednesday's extended session.

The engine fueling the company's financial growth over the past year has been Nvidia's AI-intensive data center sector, which generated $22.6 billion in sales last quarter-a 427% year-over-year jump and an incredible 20 times greater than the $1.1 billion that the division took in in 2020.

Nvidia Stocks Soar

Following an astoundingly successful earnings report showing a 268% revenue gain and a 628% profit increase, Nvidia's stock price recently jumped 4%.

Nvidia said that it will split its shares 10-for-1 on June 7th, maintaining the company's total valuation while reducing the price per share from roughly $950 to $95—a move that will enable investors and employees to more easily get complete shares.

CFO Colette Kress stated that although non-hyper scalers use more Nvidia processors, big cloud providers account for roughly 45% of the company's data center sales.

The Data Center segment accounted for 86% of Nvidia's total quarterly sales, with revenue rising 427% year over year to $22.6 billion.

However, Kress pointed out that the company's revenue from China fell significantly during the quarter because it had to stop exporting its strongest chips to that country.

(Photo: Tech Times)

![Apple Watch Series 10 [GPS 42mm]](https://d.techtimes.com/en/full/453899/apple-watch-series-10-gps-42mm.jpg?w=184&h=103&f=9fb3c2ea2db928c663d1d2eadbcb3e52)