This year has been excellent for crypto prices. We all enjoyed Bitcoin hitting a new all-time high (ATH) while meme coins experienced wild rallies. However, on the regulatory front, it is turning out to be a rather tough year.

As crypto assets gain wider adoption each year, regulatory scrutiny of the sector continues to increase. This has led to a situation where some regions are embracing crypto with friendly policies while others are taking hostile enforcement actions.

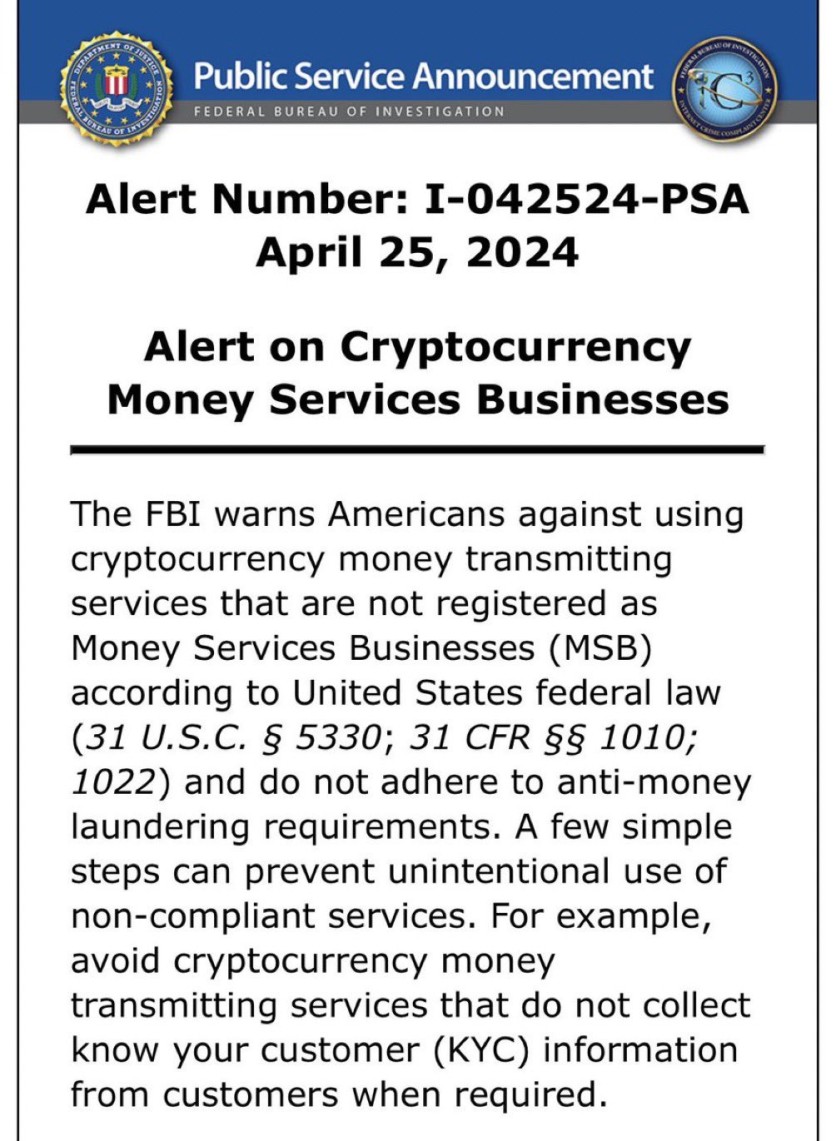

Recently, some of the most aggressive moves against crypto by regulators have occurred in the US. Just this week, the founders of Samourai Wallet were charged with conspiracy to commit money laundering and operating an unlicensed money transmitter business.

While the founders were arrested, the website, which was hosted in Iceland, was seized, and a warrant was issued for its mobile application. This comes less than a year after Tornado Cash was charged with the same crimes along with sanctions violation.

This is just the tip of the iceberg, though. Just a couple of months ago, the SEC broadened the definition of a "dealer" to include even liquidity providers. According to the regulator's approach, anyone who simply buys and sells securities as part of their business can be considered a dealer.

Now, ahead of the Ether Spot ETF application deadline, the SEC has issued a Wells Notice to MetaMask for operating without a license. Previously, a similar notice was sent to the decentralized exchange (DEX) Uniswap. Big crypto firms like Kraken, Coinbase, and Ripple are already engaged in a legal battle against the country's securities regulator.

As can be seen, it is becoming extremely difficult for crypto projects to innovate in the US, let alone cater to its people.

"Crypto is on the front line of the war for individual liberty in the digital age. So many rights are at stake: free speech, association, financial privacy, property ownership, on and on," said Jake Chervinsky, chief legal officer at Variant, in an X post. As for what the crypto community can do in this regard, "There's no magic bullet to win this fight. We all just have to grind it out," he added.

The crypto community isn't sitting silent; they are fighting back with MetaMask's parent company, ConsenSys, suing the SEC and challenging the agency's authority to regulate ETH as security. Meanwhile, crypto lobbyists, The Blockchain Association, and the Crypto Freedom Alliance of Texas have filed a lawsuit, challenging the SEC's dealer rule.

This anti-crypto stance isn't limited to the US. In another part of the world, the European Parliament is targeting crypto firms and cash payments above €10,000 to tighten money laundering and terrorist financing measures across the European Union. This includes enhanced checks on customer identity as well as unfiltered and immediate access to beneficial ownership information for journalists and CSOs.

The UK, meanwhile, is giving law enforcement agencies more power to freeze, seize, and destroy crypto used by criminals without first making an arrest.

Through their draconian laws, regulators are not only curbing innovation in the sector and effectively choking the life force of crypto but also stealing people's right to privacy.

Authorities have already forced privacy coins to be delisted from cryptocurrency exchanges. Now, by taking action against platforms that provide privacy services, there is a clear motive against enabling people to keep their information private.

It's certainly a big moment for crypto when the core values of Bitcoin and cryptocurrencies are being attacked at such a large scale.

As Ethereum co-founder Vitalik Buterin noted, "Crypto is not just about trading tokens, it's part of a broader ethos of protecting freedom and privacy and keeping power in the hands of the little guy. And these values unfortunately continue to be under attack, globally."

This is not to say that crypto isn't being embraced by other nations. El Salvador and Hong Kong are good examples where regulators have taken a positive approach. However, the dire effects of negative crypto regulations in the US and the EU are simply too big to ignore.

"We are at a critical point," said Ape Terminal Founder Hassan Hatu Sheikh, noting that "the regulatory space is heating up, with the next few years looking crucial for the evolution of crypto regulations." He insists that the crypto community come together in this war against regulatory attacks on crypto's ethos if we want to thrive as an industry and continue to have an opportunity to build solutions for the betterment of society.

"The coming years could be a tipping point for crypto as regulators finalize crypto regulations. With that, we can see a seismic shift in the space with developers choosing to launch their projects in jurisdictions that provide clarity and support innovation," said Sheikh.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.