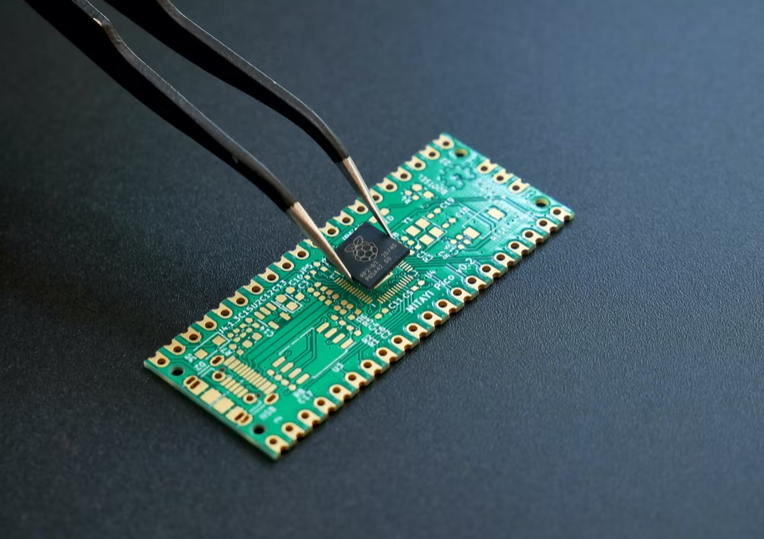

China's semiconductor industry is preparing for a significant milestone, amid mounting challenges from US export restrictions.

Despite Washington's efforts to slow the development of advanced chip technologies, the Financial Times reports that Chinese chipmakers, led by Semiconductor Manufacturing International Corp (SMIC), are planning to produce next-generation smartphone processors as early as this year.

China's Self-Reliance on Chip Production

The same report tells us that SMIC, China's top chipmaker, has reportedly established new semiconductor production lines in Shanghai to mass-produce chips designed by technology giant Huawei.

This move aligns with Beijing's objectives of achieving self-reliance in semiconductor production, a strategic goal that has gained momentum amid escalating tensions with the United States.

The US government's export restrictions, particularly on technology transfers to SMIC, have posed significant challenges for Chinese chipmakers. However, SMIC aims to leverage its existing stock of US and Dutch-made equipment to produce more miniaturized 5-nanometer chips, Reuters reports.

While these chips remain a generation behind the cutting-edge 3-nanometer ones, the development signifies China's gradual progress in semiconductor manufacturing despite export controls.

Huawei's Advanced Chip Tech

Huawei's flagship smartphones have been at the forefront of showcasing advancements in chip technology. The Mate 60 Pro, featuring a 7-nanometer processor, surprised industry analysts with its performance and contributed to increased shipments in China.

With impressive flagship sales, Huawei has recently reclaimed its dominance in China's smartphone market, dethroning competitors and industry leaders like Apple in the first few weeks of 2024.

Financial Times notes that with plans to produce more advanced chips, including the Ascend 920 AI processor, Huawei aims to strengthen its competitiveness in the smartphone market further.

Challenges Ahead

However, SMIC faces challenges such as increased production costs and lower yield compared to competitors like Taiwan Semiconductor Manufacturing Company (TSMC).

The company is reportedly charging higher prices for products from its 5-nanometer and 7-nanometer fabrication nodes, indicating potential financial strains amid the technological race.

The implications of export restrictions are significant, with the Dutch government's recent revocation of export licenses for advanced chipmaking equipment posing hurdles for SMIC's production expansion.

Analysts speculate on the motivations behind SMIC and Huawei's chip production efforts, raising questions about the sustainability of the endeavor given the financial and technological constraints.

The future development of China's chip industry remains uncertain, with the fate of SMIC's production lines playing a pivotal role. Experts highlight the complexities and uncertainties surrounding China's semiconductor development, emphasizing the need for innovative solutions to overcome challenges and achieve self-sufficiency in chip manufacturing.

In Other News

The United States is set to impose visa bans on individuals associated with spyware targeting journalists and activists. Under this new policy, visas can be restricted for investors, company leaders, and individuals representing governments involved in unlawful surveillance.

Stay posted here at Tech Times.

Related Article : US-Blacklisted Huawei Tops China Smartphone Sales, Fueled by Mate 60 Pro 5G Success

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.