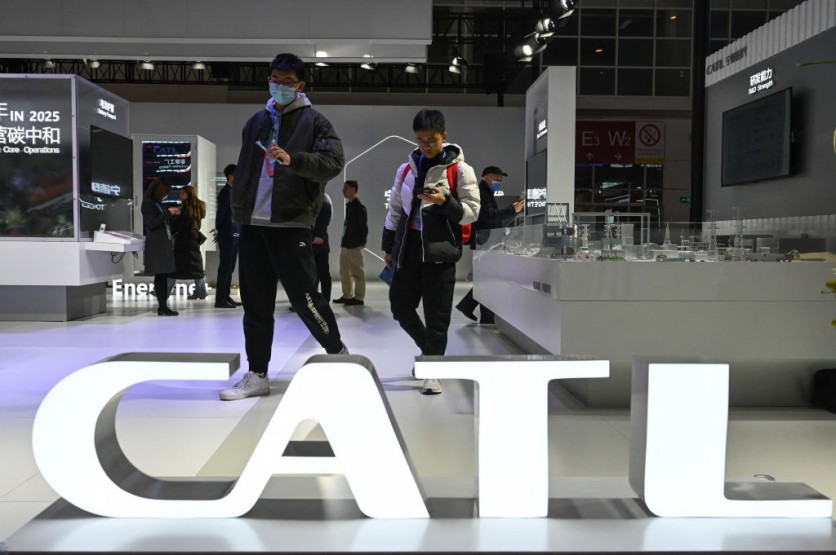

The major Chinese electric vehicle (EV) battery firm CATL and DiDi, a prominent ride-hailing platform, established a strategic agreement to improve battery-swapping technology in China's burgeoning EV charging infrastructure market.

China's EV Revolution

This follows China's Ministry of Industry and Information Technology's December support for battery-swapping technology. The government will undertake public transit pilot projects to promote EV infrastructure.

The Electric Vehicle Charging Infrastructure Promotion Alliance reports 3,567 battery-swapping stations in China in December 2023, up 80% from 2,000 in January. Public charging stations in China will increase by 50% to 2.7 million by 2023 from 1.8 million in January.

Nio, a leading Chinese EV company, has 2,333 battery-swapping facilities. Collaborating with automakers like Changan Automobile and Geely, Nio actively works on standardizing swapping protocols to drive widespread adoption. Batteries can be swapped in minutes, compared to the 20-minute charge time for a 300-mile (483km) range.

$NIO Banyan update! Battery swappikg without power interruption! https://t.co/F1rcldLPY6

— NIO (@NIO_Worldwide) January 26, 2024

Beyond the collaboration, CATL is expanding its influence by partnering with Xiaoju Energy, DiDi's new energy solutions provider, to offer charging services in over 190 Chinese cities. This comprehensive strategy highlights collaborative efforts to accelerate China's EV infrastructure development and promote sustainable transportation solutions.

Read Also: Microsoft CEO Satya Nadella Expresses Alarm Over Taylor Swift Deepfakes Circulating Online

Nikkei Aisa reported last month that an Abu Dhabi-backed fund was planning to invest $2.2 billion in Chinese electric vehicle manufacturer Nio. CYVN Holdings will purchase 294 million newly issued Nio shares at $7.50 each by the end of the month, increasing CYVN's ownership in Nio to around 20.1%. This follows CYVN's prior investment of $738.5 million in July, along with the acquisition of Nio shares from Tencent Holdings, securing a total 7% stake in Nio.

Elon Musk's Warning: Chinese EV Makers to Dominate Market

Recent developments in the EV industry prompted Tesla CEO Elon Musk to warn about Chinese EV companies' competitive challenges without trade barriers. The tech mogul acknowledged the rising strength of Chinese EV producers and BYD's fierce battle with Tesla, according to a report from Fortune.

In Q4 2023, BYD surpassed Tesla as the world's top-selling EV brand, selling 526,409 pure electric vehicles compared to Tesla's approximately 486,409. Musk's perspective on Chinese EVs has evolved, recognizing their competitiveness compared to his earlier assessments in 2011.

After the European Commission launched an anti-subsidy probe against Chinese EV firms in September, the Biden administration banned cars utilizing Chinese battery components, impacting Tesla's consumer tax credits. The U.S. charges 25% on Chinese automobiles and 2.5% on all auto imports. Biden prolonged the Trump-era China-specific tariff. The EU charges 10% on imported cars, while China charges depending on origin.

Related Article : Tesla Recall 2024: Rearview Camera Bug Prompts Automaker to Cancel Nearly 200,000 Cars

![Apple Watch Series 10 [GPS 42mm]](https://d.techtimes.com/en/full/453899/apple-watch-series-10-gps-42mm.jpg?w=184&h=103&f=9fb3c2ea2db928c663d1d2eadbcb3e52)