Reaping investment returns requires patience, strategy, and high-risk tolerance to meet one's financial objectives. With the best portfolio management software, investors can easily oversee, select, and build their assets by tracking and managing their investor portfolios in one place. It offers a holistic view of their investments, combining all relevant data and tools necessary for investment analysis.

Why Use Portfolio Management Software?

Investment portfolio management software assists in maximizing the expected returns of an investment. It streamlines all portfolio management activities, including tracking and analyzing investments, trading assets, and even managing the risks involved in investing. With access to the latest financial information from market data sources, it offers insights to help investors make informed decisions and create projections based on the performance of their portfolios.

Listed below are the top 5 best investment portfolio management software of 2023:

1 EquityStat Stock Portfolio Tracker

Overview

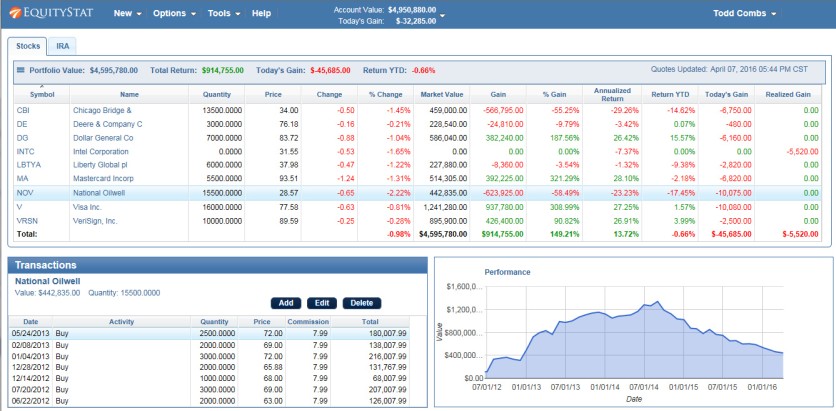

EquityStat offers a convenient and efficient way to track and manage all investments in one place through its stock portfolio tracker, developed by investors specifically for investors. As a financial investment portfolio software, it offers a complete picture of all accounts where investors can see a summation of their total holdings without losing sight of each stock, portfolio, and account's performance.

The developers of EquityStat aim to address the limitations of other portfolio management software. They found that existing tools for tracking and evaluating financial investments were inadequate due to a lack of useful features and were mostly designed for buying and selling stocks, while other investment portfolio trackers were limited to one operating system.

With the creation of EquityStat, it's possible to track and manage all investments in one application from the cloud, made accessible from any device. Currently, it is free to use, compatible with any operating system, and supports any device for a comprehensive view of portfolios. The stock portfolio tracker matches the screen of the device for maximum coverage.

EquityStat also contains multiple performance metrics that display the investments' daily, quarterly, or annual performance. It offers easy and powerful calculations that investors can use for evaluation. While they may need to enter all their investment transactions manually, the portfolio management software enables bulk import and customizations.

Besides dividends, stocks, and other mutual funds, investors may also track their cash as quickly as they track their investments.

Features

Access to Complete Portfolio

Many investors have investments in a brokerage account. They can also own mutual funds and probably have a 401K with their employer. EquityStat eliminates the need to log into all multiple brokerage and mutual funds accounts to view each portfolio.

With its stock portfolio tracker, investors can access their complete portfolio in one location. They can track, manage, and analyze their respective stocks, funds, and EFTs in the program. All transactions are grouped, making it easier to view, update, or remove existing investments.

The stock portfolio tracker can display summary graphs and performance metrics for comprehensive analysis. Investors can easily compare their portfolio and account performance to the S&P 500, Dow Jones, and Nasdaq indexes. This also applies to each investment, making it easier to thoroughly assess each portfolio for performance analysis.

Real-time Quotes and Performance Metrics

EquityStat provides real-time quotes and performance metrics with its stock portfolio tracker, both for the overall summary and individual investments, whether that would be stocks, mutual funds, or 401k. Investors can track their investments' gains and quarterly, year-to-date, or annualized returns.

All transactions are available for viewing for each investment. Its user-friendly interface allows investors to easily look up investments by symbol or name.

Easy Customization

EquityStat offers easy customization of multiple portfolios. It provides various columns or metrics to display, including market value, year-to-date return, annualized return, % gain, today's gain, and many more. This allows investors to categorize each investment according to its name, value, return, and gain and to sort transactions by date, transaction type, and amount.

The stock portfolio tracker has a responsive design, so no matter what device it's viewed on, it adapts to its screen size, whether through a desktop or mobile screen.

Calculations & Tax Reporting

Unlike other portfolio management software, EquityStat contains financial formulas for easy and powerful calculations. This enables investors to properly evaluate the performance of their investment portfolio. With the entire portfolio in one place, the online program can determine and display the user's net worth.

EquityStat also enables the generation of IRS forms for tax reporting. Investors may calculate their costs basis, gains, and losses directly on the spot portfolio tracker to fill out the IRS Form 8949. Besides tax forms, investors may also export their transactions to a spreadsheet for safe backup.

Users commend EquityStat for its functions, highlighting its ability to showcase multiple portfolios and track and measure each investment's performance in a specific duration. Being a relatively new and simple portfolio management software, it is well-designed and easy to use, enabling users to easily understand their investments.

With easy customization, a user-friendly interface, and powerful calculations, anyone can rely on this investment portfolio tracker to manage their assets. The free stock portfolio tracker of EquityStat is recommended for all types of users, even those lacking the required investment expertise and management software.

2 Yahoo Finance

Overview

Yahoo! Finance doubles as a portfolio management software through its stock portfolio tracker. The platform enables anyone to track their stock portfolios or watch list, and it can automatically determine their day gain and total gain.

It supports synchronization with brokerage accounts, allowing users to merge and track their investments. By being able to monitor their performance, this enables investors to understand where potential risks lie. Investors also have the option to enter portfolio holdings manually instead of linking existing brokerage accounts, yet Yahoo assures it does not store any broker credentials.

Features

The stock portfolio tracker of Yahoo! Finance enables the following of collected stocks by creating watch lists and portfolios based on actual or potential holdings. Once the following is established, it grants access to multiple analytics, offering invaluable insight into collected stocks.

Users can also customize their portfolio lists in the Yahoo! Finance app. They can create, rename, delete, or simply reorder the lists they own or those they follow. They may also rearrange and sort the symbols to quickly access their most important stocks. Unfortunately, this customization is only limited to iOS.

Yahoo! Finance also offers market indices as a benchmark for the created portfolio. Users may choose what characteristics they want to track and in what setting they intend to view their portfolio (basic, performance, real-time, active portfolio, fundamentals, or detailed). After curation, the platform displays all the necessary information to track the portfolio.

3 Morningstar Investor

Overview

Morningstar Investor enables objective evaluation of portfolios through its insights and powerful tools. It aims to bring clarity to every investment decision. This portfolio management software is also created to strengthen the investment strategy with independent research along with its features.

Features

The Morning Star Investor contains a portfolio x-ray to evaluate holdings from every angle. It displays asset allocation, fees, stats, weightings, and more information. With its stock intersection, investors can easily identify which assets overlap that may affect its diversification.

This portfolio management software also offers trusted ratings and comprehensive data, enabling users to monitor the performance of their investments. In addition, it also supports account integration, which is crucial to gain a holistic analysis of all holdings.

Users may screen their holdings through the performance and valuation metrics of Morningstar Investor, together with its independent analysis and ratings. The software also contains pre-filtered investment lists, showcasing the best investments available in the market. Users may filter through ratings, investment types, criteria, and so on to display their desired results.

With seamless account aggregation and display of the latest investments via watchlists, Morningstar Investor provides substantial context through analysis commentary and market trends tailored to the holdings and the following preferences of the investor.

4 Google Finance

Overview

Google Finance is the stock portfolio tracker from the multinational tech company and search engine giant. It keeps track of personal investments, offers real-time pricing updates, and provides the net worth of a user's portfolios. It also offers valuable information through market trends to make informed investment decisions. Google Finance tailors its stock and investment suggestions based on user preference and enables organization through a customized watch list.

Features

Google Finance supports easy navigation of market trends, making it easier to find and compare information. By grouping stocks and building their watch lists, users receive relevant news, stats, and earning details on the performance of the stocks they're following.

Given the variety of products from the global tech company, users may also add company events and earning calls to their Google Calendar to stay updated on stock movements.

This stock portfolio tracker also supports cross-platform viewing, making it more accessible to users to keep track of their investments and stay on top of market trends. Google Finance also offers explanations and descriptions of key terms and stats of market stocks as users browse for information. They simply need to hover over the term to view its definition.

With its portfolio feature, users can create and customize their portfolios, track their gains and losses, and review relevant news concerning their investments alongside the ones in their watch lists.

Google Finance is a simple and free stock portfolio tracker. It contains the fundamentals that are essential for investment portfolio management, like comparison of performances and real-time information on stocks. While it is now incorporated into the search engine, it still provides valuable insights into the latest market trends and financial news of the biggest businesses in the world.

5 MSN Money

Overview

MSN Money is Microsoft's portfolio manager. Like other stock portfolio trackers by well-known brands, it offers financial news and data related to different assets. The platform doesn't fall short in providing essential information. It displays the performance of stocks, from their movements to projections, and enables comparison with the competition. Users can also add portfolios to their watch list to keep track of their market value.

Features

With the changes made to MSN Money, the portfolio manager is now combined with the user's watch list, making it easier to track all stocks in one place while monitoring portfolio holdings and performance. This also extends to funds, indexes, currencies, and commodities. MSN Money also grants easy access to popular searches, top gainers and losers, and more.

With its recent update, MSN Money allows users to track international investments in other currencies. They also have the option to add transactions in a foreign currency or modify the exchange rate received from the broker when the transaction occurs. MSN Money also has a new feature called Quicklist. It enables the synchronization of financial instruments across multiple products and services like Bing, Edge, and Cortana.

MSN Money doesn't differ much from its competition regarding focus and design. While it offers a comprehensive view of market trends and prices, along with the updated performance of each stock, the portfolio manager is focused on the trade instead of insights when making informed decisions from an independent analysis. It falls short on customization, yet it is recommended for easy access to key information.

Conclusion

Overall, these five investment portfolio management software contain the essential features for portfolio tracking, performance metrics, and staying on top of market trends. While some may have more advantages than others, like the customization and calculations of EquityStat, investors can rely on these platforms to manage their investments and maximize their returns.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.