Razer Merchant Services (RMS), the B2B arm of Razer Fintech, today announces that it has obtained Visa's Direct Acquiring license in the Philippines, Singapore, and Malaysia, as part of a regional partnership.

Simultaneously, RMS is now certified with the Visa Token Service (VTS) to provide a secured and encrypted card payment service deployed during card payment transactions for merchants. Through this partnership with Visa, RMS aims to expand the card scheme to these countries across different industry verticals, including hawkers, e-hailing, market traders, on-demand services, e-sports, government, and education.

The other Visa solution in the full suite offered by RMS to its merchants is Rapid Seller Onboarding (RSO). RSO is a digital onboarding, due diligence (including risk scoring), and underwriting (an approval sought to confirm the onboarding of merchant) solution utilized once merchants sign up for it through RMS' digital onboarding portal. This affords merchants the convenience of onboarding themselves online on the RMS website while due diligence and compliance checks are conducted in the background.

RMS' holistic card scheme payment ecosystem will be further enhanced with its RMS Virtual Terminal app that turns merchant smartphones into payment terminals, tapping into its current offline physical merchant base of more than 40,000 QR payment touchpoints. The VT App will seamlessly add contactless card acceptance via Tap-on-Phone technology through its efficient and cost-effective application compared to conventional terminal deployments.

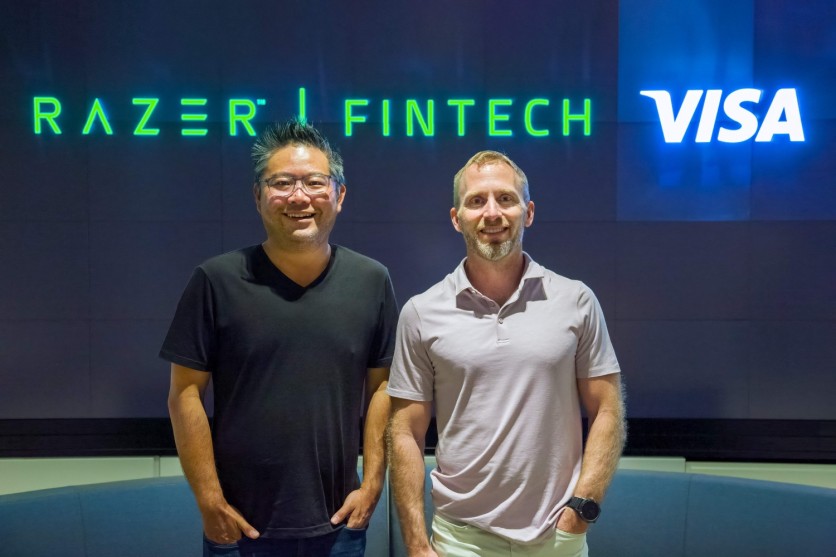

"RMS wants to empower more SME merchants with the ability to reach millions of cards and accounts across Southeast Asia. Through this partnership with Visa, RMS streamlines our initiatives of digitising payments for merchants across the Philippines, Singapore and Malaysia," said Lee Li Meng, CEO of Razer Fintech. "We will look to replicate this across other Southeast Asian countries like Thailand, Indonesia, Taiwan, and Hong Kong. RMS merchant's customers will also benefit from a secure and improved payment experience through our VTS solution. We continue enabling innovative payment features to ensure our merchants are equipped with the best payment options at their disposal."

Neil Mumm, Head of Merchant Sales and Acquiring, Asia Pacific, Visa said, "Many small businesses recognise the need to digitise payments yet they lack the resources and know-how to do so. This is why, at Visa, we create solutions to make merchant onboarding more seamless, and to help merchants accept Visa card payments easily and securely. We are glad to partner with Razer Merchant Services as this will help to accelerate payments digitisation across the Philippines, Singapore and Malaysia, so merchants can start to offer the digital and intuitive payment experiences that consumers are already embracing."

To further facilitate Small & Medium Enterprises (SMEs) merchants' digital migration, RMS will enable a fully digital onboarding process for merchants to accelerate enrolment and underwriting. Through this process, SMEs and Micro merchants such as hawkers will be able to process payments within minutes of signing up on RMS' website.

In tandem with accelerating the signup process, an added layer of security will be fulfilled through the VTS solution. Customers at RMS merchant businesses can benefit from an additional layer of security through the encryption of tokenized services which replaces a cardholder's 16-digit account number with a token that only Visa would be privy to, therefore, protecting the underlying card details.