Generative AI has opened up a plethora of possibilities. From quickly writing emails and résumés to preparing for interviews and even coding, AI is revolutionizing the world. Fortunately, the rapidly evolving AI technology has paved the way for innovative solutions to streamline and enhance personal finance management. With the ability to learn and adapt from vast amounts of financial data, AI will allow individuals to gain valuable insights, automate routine tasks, and receive personalized recommendations tailored to their unique financial goals.

For many years, many finance and banking companies like Ally and Capital One have integrated AI into their services. One key distinction between these AI and personal finance models compared to others is that banks have a tendency to be influenced by their own biases. Additionally, banks frequently lack access to the user's full information and the necessary machine learning technology to effectively utilize GPT and AI to offer precise, tailored advice. In other words, banks have a primitive version of AI, not the generative, language learning AI that other personal finance programs have.

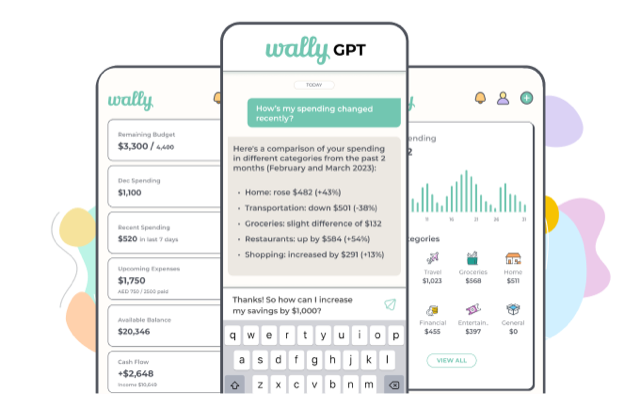

"Financial advice needs to be holistic and based on the user's comprehensive financial data," remarks Saeid Hejazi, founder of WallyGPT, a GPT-powered personal finance app. "Users should be able to connect all their financial information - including their banking information, as well as credit cards, loans from other banks, investments, debts, etc."

With apps like WallyGPT, people can make great strides in reaching their financial goals by utilizing generative AI.

Generative AI Applications in Personal Finance Management

Generative AI creates new content based on patterns and existing data. With your financial information, AI can help with your customized, personalized financial management plan. "As a personal finance tool," notes Hejazi, "Wally provides deeper insights and helps people research and make financial plans through conversations."

AI can automate budgeting and expense tracking by analyzing spending patterns and categorizing expenses. This level of analysis saves time and provides individuals with a deeper understanding of their financial habits. "We once had a user report to us how they got roasted by WallyGPT. They found it brutally honest yet hilarious. More importantly, it made them realize what needed to be taken seriously," shares Hejazi.

AI algorithms paired with financial algorithms can even offer intelligent financial advice and recommendations based on individual financial goals, either long-term or short-term, for an event. "For example, we had a user plan their wedding. They listed the city, what items they wanted to include, their budget, liabilities, etc.," shares Hejazi. "Wally provided an in-depth analysis of their wedding budget."

By analyzing various financial aspects, such as income, expenses, savings, and debt, AI can garner personalized suggestions for a budget plan and other crucial areas of personal finance.

AI data and the human touch

The collaboration between generative AI and human personal finance assistants combines the strengths of both approaches. Human personal finance assistants bring their expertise, intuition, and ability to understand nuanced financial situations, while generative AI provides advanced data analysis, pattern recognition, personalization, and automation capabilities.

Personal finance is highly individualized, and generative AI can contribute to personalization efforts. While human personal finance assistants can offer tailored advice based on their knowledge and experience, generative AI can further enhance personalization by considering a broader range of data points and individual preferences. It saves the human personal finance advisor time by analyzing the individual's data (income, debt, credit cards, spending habits, etc.) and providing talking points to go over with the advisor. This partnership helps create personalized financial strategies that align closely with the individual's goals, risk tolerance, and financial situation.

The Future of Generative AI in Personal Finance Management

The potential of generative AI in personal finance management is vast, and as technology continues to evolve, its role is expected to expand even further. AI can offer increasingly personalized and customized financial recommendations. Generative AI can provide tailored insights and strategies to align with individual financial goals, preferences, and unique circumstances by incorporating a broader range of data sources and leveraging advanced algorithms.

The future of generative AI as a personal finance assistant is possible, but not the goal. "Although WallyGPT can answer a wide range of questions across all personal finance with hyper-personalized answers, it should not be considered providing financial advice without consulting a certified personal finance advisor," reminds Saeid Hejazi. AI algorithms can provide individuals with data-driven insights, recommendations, and simulations, while humans can contribute their judgment, values, and intuition to make informed financial decisions. These AI-human partnerships can lead to more holistic and well-informed decision-making processes.

Generative AI has ushered in a new era of possibilities for many sectors in the digital world. The possibilities for personal finances are endless. By harnessing the power of generative AI, individuals can gain valuable insights, automate tasks, and receive personalized recommendations tailored to their unique financial goals. Integrating AI with personal finance advisors creates a powerful collaboration, combining the advanced capabilities of AI with the expertise and empathy of humans. The future holds tremendous potential for leveraging generative AI to empower individuals, optimize financial strategies, and improve overall economic well-being.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.