In today's digital age, Identity Verification (IDV) has become integral to various aspects of our lives. Whether it's applying for a credit card, changing jobs, or exploring new car rental services, the reliance on solutions supplied by the market's most promising identity verification providers has grown significantly.

We have handpicked the top 5 identity verification software, revolutionizing the industry. These trailblazers are setting new standards in efficiency and redefining the user experience with cutting-edge technology.

Identity Verification in 2023

As the digital landscape continues to evolve, cybercriminals consistently look for new ways to exploit vulnerabilities. To combat this ever-present threat, businesses and consumers must embrace advanced and robust IDV solutions to protect their digital identity and sensitive information.

In the simplest form, IDV can be defined as confirming that an individual is who they claim to be. When businesses verify and authenticate the identities of their customers accurately, they can prevent fraud and comply with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML).

Identity verification encompasses a wide range of methods, including biometric authentication, ID verification, liveness detection, voice recognition, multi-factor authentication, and database checks. Its applications span heavily regulated industries, from financial institutions and healthcare to e-commerce and telecoms.

This was not always the case. In the past, businesses would verify identities using manual checks. Unsurprisingly, this has proven to be time-consuming and prone to errors. With the emergence of innovative technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Biometrics, the identity verification process is easier than ever.

Top 5 Identity Verification Providers in 2023

The leading identity verification providers of 2023 have been ranked based on a variety of factors, including customer satisfaction, pricing, functionality, and user experience. A more granular comparison of these top-tier solutions is outlined further down.

#1 ComplyCube

ComplyCube stands out as a beacon of innovation, accuracy, and efficiency with its unique blend of AI/ML technology. The global IDV platform caters to a broad spectrum of businesses, providing end-to-end KYC and AML solutions. Its clients span startups, scale-ups, multinationals, and listed firms.

The AI-driven platform enables businesses to enact holistic AML/KYC compliance using a feature-rich, user-friendly, and highly customizable suite of identity verification services: document verification, biometric identification, liveness detection, age verification, PEP & Sanctions screening, video verification, and more.

Furthermore, the ISO-certified platform touts its solutions as having the fastest omnichannel integration turnaround in the market with low/no-code solutions, API, mobile SDKs, client libraries, and CRM integrations.

ComplyCube is our top choice for businesses looking to enhance security and AML/KYC compliance while decreasing false positives and operational costs. It is also worth mentioning that it offers a highly generous and unrivaled startup program (up to $50,000 credits).

Highlights

- Boasts the most extensive range of checks: AML screening, ID document verification, biometric checks, address verification, electronic Identity Verification (eIDV), and more.

- The best coverage, pricing flexibility, and user experience on the market.

- High user satisfaction with excellent ratings with 5/5 stars on G2 and Capterra and is top-rated on TrustRadius.

#2 SumSub

SumSub is an identity verification provider offering various services for businesses seeking to enhance their compliance efforts. With an emphasis on KYC and AML regulations, the platform provides solutions to reduce risk and assist companies in meeting their compliance obligations.

The IDV platform uses AI/ML to detect anomalies and potential security threats. This approach helps businesses manage compliance more efficiently. It utilizes technologies such as liveness detection, facial recognition, and validation of identity documents to ensure accurate verification and maintain compliance.

In terms of usability, SumSub has developed an interface that is relatively straightforward to navigate. It offers an accessible platform for businesses to manage their validation processes.

Highlights

- Allows for integration with a limited set of systems, facilitating a degree of flexibility.

- Second-best granularity when scanning its pricing table.

- The company is rated at 4.5 out of 5 on G2 and 4.7 out of 5 on Capterra.

#3 Shufti Pro

Shufti Pro provides dependable customer identity verification software that includes document verification, biometric screening, electronic ID verification, and facial recognition to ensure reliable and accurate identity checks. It delivers global coverage and enables companies to scan a user's identity across different regions, complying with local regulations.

The platform employs identity fraud prevention measures to protect businesses and customers from fraudulent activities. It uses artificial intelligence and monitoring to detect suspicious behavior and fraudulent transactions.

Shufti Pro helps businesses minimize financial losses and maintain customer trust by identifying and mitigating potential risks.

Highlights

- Offers a web-based interface, which can be accessed on multiple devices.

- Delivers a standard suite of verification features, including document scanning, COVID certificate validation, and facial comparison.

- The company is rated at 4.4 out of 5 on G2.

#4 Veriff

Veriff is an Estonia-based identity verification company that offers a comprehensive solution to online businesses. It helps organizations establish trust, fortify fraud prevention, and ensure compliance with regulatory requirements.

The platform has developed a suite of services targeting businesses of various scales, offering adaptable solutions for diverse operational requirements. Veriff's identity verification software combines document verification, biometric analysis, and facial recognition algorithms to confirm a user's identity.

The company caters to industries such as finance, e-commerce, and sharing economy businesses. The platform offers global coverage, enabling organizations to verify customer IDs from various regions. Veriff helps enhance security and streamline onboarding processes.

Highlights

- The system operates on a user-friendly interface, though it may lack some advanced features compared to other providers.

- Second-best document coverage on the market.

- The company is rated at 4.4 out of 5 on G2 and 4 out of 5 on Capterra.

#5 Onfido

Onfido is an identity verification platform that employs AI and ML to confirm the authenticity of user identities in online environments. The company provides various identity verification software features such as liveness verification, document scanning, video verification, facial recognition, and biometric analysis.

The platform enables businesses to enhance security and simplify the customer acquisition journey. Onfido's algorithms and data sets aim to detect forged official documents and fraudulent activities, improving accuracy.

The company's API integration and customizable workflows cater to the unique needs of different businesses. Onfido provides a solution for remote identity verification, helping organizations establish trust with their customers.

Highlights

- Onfido offers 24/7 customer support.

- Delivers one of the broadest ranges of offers on the market, but several features are reserved for enterprise clients.

- The company is rated at 4.4 out of 5 on G2 and 4.7 out of 5 on Capterra.

Top 5 Identity Verification Providers Comparison

In the following section, we provide a more detailed comparison of the top 5 identity verification providers in 2023, shedding light on their distinct capabilities, services, pricing, and performance.

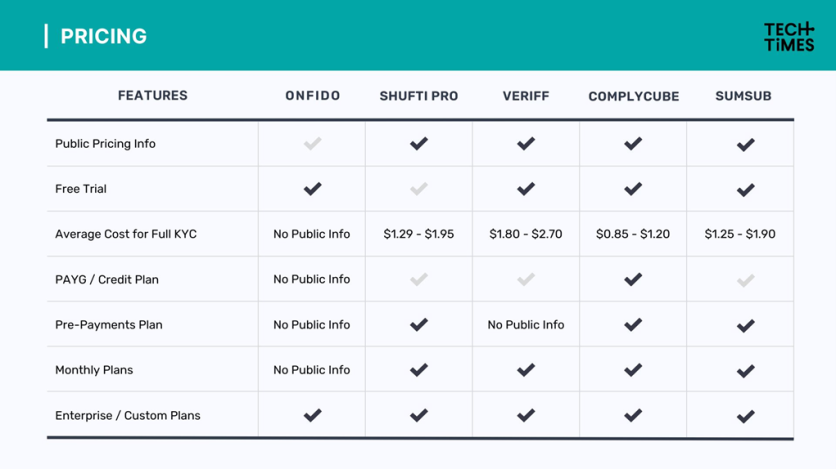

Pricing

When considering pricing, it is essential to find a solution that strikes a balance between effectiveness and cost. In this regard, ComplyCube emerges as a standout provider, delivering the most granular pricing table on the market with a comprehensive range of pricing options, including pay-as-you-go, monthly, and enterprise plans.

SumSub comes in second with a less adjustable offering, yet still better than other competitors. It's worth noting that Onfido, while recognized for its identity verification capabilities, does not publicly disclose its pricing information, making it difficult for potential customers to compare and assess its cost-effectiveness.

Capability

Identity verification software varies in capabilities. Some solutions stand out by providing a more extensive range of products. These comprehensive offerings give businesses a holistic approach to identity verification, addressing multiple aspects of verifying individuals' identities.

Onfido and ComplyCube stand out by having one of the broadest range of features on the market, including but not limited to sanctions & PEP screening, document verification, biometric authentication, device intelligence, and more. However, it is worth noting that some of the advanced features offered by Onfido are exclusively available to enterprise customers, whereas their Know Your Business (KYB) offering is very limited.

In terms of channel integration options, again, Onfido and ComplyCube have the strongest offerings, with their APIs and SDKs particularly standing out for the breadth and clarity of their documentation. Veriff and Shufti Pro come second and third.

When it comes to capabilities, flexibility is a key selling point as it empowers organizations to align the identity verification service with their unique workflows, compliance needs, and risk appetite. Different vendors provide different levels of customizations, with ComplyCube and SumSub offering the most flexible and granular options in their respective online portals.

Controls

With various controls and functionalities, identity verification providers empower businesses to enhance their operational processes. These controls offer transparency, accountability, and the flexibility to customize and streamline verification workflows according to specific business and compliance requirements.

Recent political events have heightened the necessity for stricter controls and compliance measures, making ongoing monitoring an essential practice to mitigate risks effectively.

In this context, the ability to follow a full audit trail becomes essential, enabling organizations to track and document all verification processes for regulatory purposes and ensure transparency and accountability.

Coverage

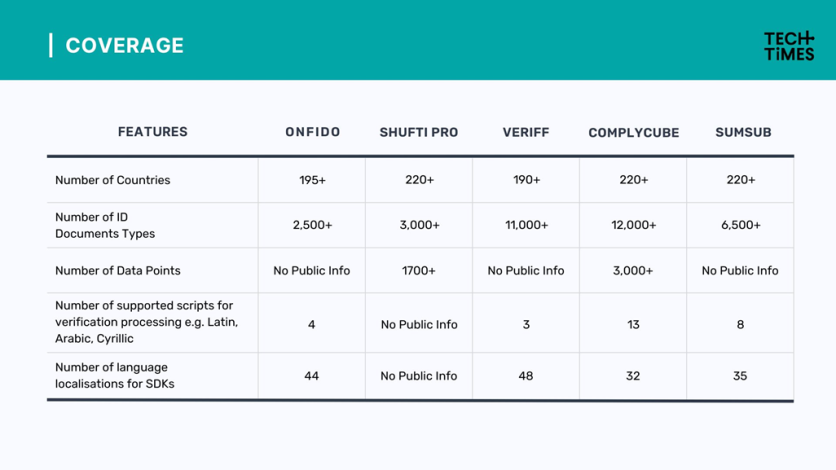

The breadth of coverage is a crucial aspect to consider if an organization performs internationally. A vital factor is the number of countries supported, which determines the global applicability of the tool.

An effective identity verification software should be able to analyze various types of identification documents from a wide range of countries, catering to diverse identification requirements. Furthermore, the tool's ability to capture and analyze a significant number of data points enhances the accuracy and reliability of the verification process.

Shufti Pro, SumSub, and ComplyCube offer comparable global coverage in terms of the number of countries served, but there is a discrepancy among them when it comes to the breadth of ID documents supported for verification.

User Experience

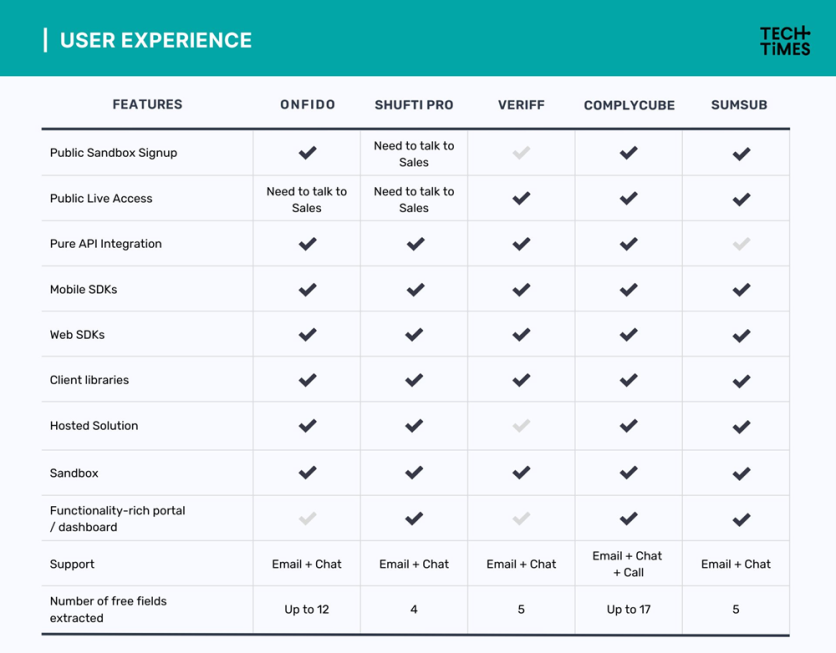

Adopting an intuitive and frictionless verification process can significantly enhance customer interaction and improve conversion rates, which drives business growth.

Choosing IDV software with robust, round-the-clock support and easy-to-integrate APIs and SDKs allows for quick troubleshooting and software updates, contributing to a positive user experience.

Shufti Pro offers a comprehensive range of options that enhance the user experience. Still, it should be noted that accessing certain features requires contacting their sales team, introducing additional friction to the process. In contrast, some other identity verification providers offer immediate and easy access.

Checklist for Selecting the Best Identity Verification Software

Choosing the right identity verification software can be a daunting task, given the multiple options available in the market. To make an informed decision, companies should consider the following factors:

Accuracy

The primary goal of IDV is to verify users accurately and prevent identity theft. Therefore, selecting a provider known for its high accuracy rates is essential.

Speed

In today's fast-paced digital environment, customers expect quick and seamless transactions when verifying identities.

Regulatory Compliance

Ensure the identity verification provider complies with industry standards and regulations, such as KYC, AML, and General Data Protection Regulation (GDPR).

Scalability

As your company grows, your business verification needs may evolve. Choose a provider that can scale its solutions to meet your changing requirements.

Ease of integration

Verify that the identity verification software offered by the provider can be easily integrated into your existing systems.

Identity Verification Software Cost

Consider the pricing structure and compare it with other providers to ensure you get the best value for your investment.

Integrating Identity Verification Software into Your Existing Systems

One of the critical factors to consider when choosing identity verification software is the ease of integrating their tools and software into your existing systems.

Many top identity verification providers offer APIs and SDKs that allow businesses to implement their solutions seamlessly. Additionally, these platforms typically offer comprehensive documentation and support to ensure a smooth integration process.

When selecting an identity verification provider, businesses should consider the ease of integration, the level of customization available, and the software's ability to scale their solutions according to the organization's needs.

Businesses can effectively implement identity verification tools by choosing a provider that fits these criteria and improves their security and compliance.

Challenges and Opportunities for Identity Verification Service Providers

Identity verification service providers face a myriad of challenges in this increasingly digitalized and complex world. The growing sophistication of fraud techniques and cyberattacks continues to complicate their tasks.

The diversity of identity documents, language barriers, and variations in global data privacy laws add to the complexity of identity verification. Another challenge is accurately verifying identities while delivering a frictionless user experience. They must stay ahead of malicious actors by continually upgrading their systems, implementing advanced AI and ML algorithms, and regularly updating their databases with the latest threat intelligence.

On the flip side, the difficulties IDV solutions face also present numerous opportunities. The digital transformation across industries has led to a surge in identity fraud cases, increasing the demand for online identity verification services.

From financial institutions to e-commerce and healthcare to online education, businesses across sectors are seeking robust and efficient AML identity verification solutions to secure their operations and comply with regulatory prerequisites. Despite the challenges, identity verification is an area with significant growth potential.

The Future of Identity Verification and Digital Security

The future of identity verification and digital security will witness significant advancements as technology evolves. Emerging technologies such as blockchain and advanced biometrics are poised to be pivotal in shaping the future landscape.

Biometric authentication is the technical process of measuring and analyzing individuals' unique physical and behavioral characteristics for identity verification. These characteristics include device fingerprinting, facial patterns, voice recognition, iris or retinal patterns, and more. Biometric systems are increasingly used in security and access control systems as they provide high accuracy.

In the future, blockchain technology is also expected to play a significant role in identity verification and digital security. By leveraging the decentralized nature of blockchain, customer data can be securely stored, encrypted, and accessed only with the explicit consent of the individuals. This eliminates the need for centralized databases, which are vulnerable to hacking and data breaches while giving individuals more control over their personal information.

Overall, the future of identity verification and digital security holds excellent promise. We will likely witness a convergence of technologies, leveraging AI, biometrics, and blockchain to create robust and seamless systems that protect individuals' identities and secure digital interactions across various industries.

Conclusion and Final Thoughts

IDV is a crucial aspect of business operations due to the ever-increasing risks of fraud and data breaches. Businesses must consider compliance, accuracy, user experience, and more when choosing the best identity verification software.

ComplyCube emerges as the best choice among the top identity verification providers in 2023, offering a comprehensive, fast, and flexible suite of services. Moreover, the platform's user-friendly interface and innovative solutions make it the ideal IDV software for regulated businesses. The identity verification platform also covers all the necessary aspects of AML and KYC compliance.

Onfido is another noteworthy player in the industry, offering solutions in document authentication, facial biometrics screening, and ID validation. Its extensive experience, technology, and commitment to delivering a smooth customer experience position it as a contender in the identity verification software market.

Finally, the choice of identity verification software will depend on each business's unique needs, regulatory requirements, and budget. Do your research, and speak to your short-listed players!

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.