Auto insurance rates tend to be different from one provider to the next because each insurer has its own unique pricing formulas when calculating its premiums. For instance, some companies will attach more significance to certain factors like age or driving experience than others.

It is also for this reason that it always helps to shop around. However, the problem is that it can often be hard to pick out the one with the best possible coverage for the least amount of money. And if you end up making the wrong choice, you may find yourself choosing an auto insurance provider that doesn't fit your needs.

Luckily, this is why car insurance comparison sites like Insurancey exist, as they make it extremely easy to explore your coverage options in detail and get the best possible deal around. So, we're going to take a look at what makes this one so different and worth using today!

Insurancey Overview

Insurancey is an independent online car insurance comparison platform that allows consumers to compare rates from some of the top insurance providers in the country. They also have an extensive network of insurers that helps streamline the process of shopping for auto insurance in an ever-evolving industry.

The service is also completely free to use, and unlike most online comparison sites, Insurancey does not utilize a lead-generation model. This means that you don't have to worry about being spammed with promotional calls, texts, and emails after you submit your personal information.

Insurancey also offers a rather simplified survey process that only takes a few minutes. You only need to fill in a few basic details about yourself and your vehicle before you are instantly presented with a list of relevant car insurance providers that can offer you coverage in your area.

You'll also be provided with plenty of additional insights to help guide your decision, and since they offer independent and unbiased services, they hold no allegiance to any single insurer. This means that you can be confident in finding the best coverage and rates available.

Plus, they only partner with reputable insurance providers, be they large or small, so all quotes provided via the site will always be reliable, accurate, and fair. And if you are unfamiliar with how auto insurance works, Insurancey even offers practical tips and advice on cancellation policies and more.

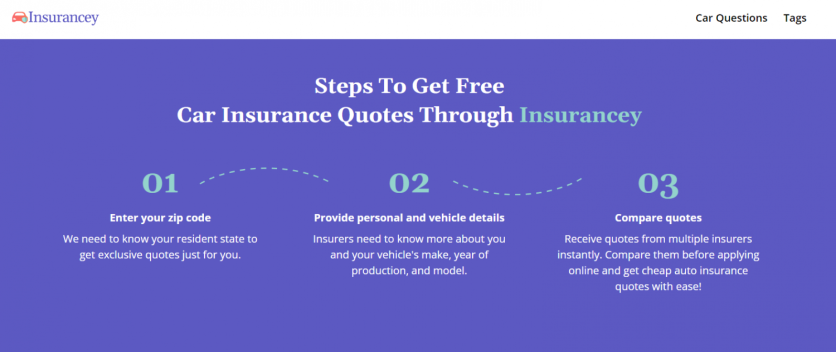

How to Get Free Auto Insurance Quotes from Insurancey?

Insurancey's online platform is designed to ensure that consumers are able to access the quotes they need without much hassle or need for excess paperwork. As a result, the entire process should only take a few minutes to complete.

Step 1: Input relevant details on the online form

The first step requires you to open the Insurancey website on your browser window. Once you are on the homepage, you will need to input your ZIP code before sharing personal details such as your name, email, and address, as well as information about your driving history, accident history, car's specifications, etc. This information is what Insurancey will use to create an accurate profile that fields quotes from the insurers within their network.

Step 2: Compare auto insurance quotes

Once the survey form is submitted, the platform will generate a list of relevant quotes from top insurers within your area in a matter of minutes, based on your personal and vehicle profiles. Keep in mind that every insurance provider evaluates rates using their own unique determinants, so the rates and level of coverage offered may vary dramatically.

Step 3: Proceed to the insurer's site

Once you have reviewed the quotes and found the ideal policy that fits your budget and requirements, you can proceed to the insurance provider's site. From there, you will be able to finalize the application with your chosen insurer and purchase your preferred auto insurance coverage.

Why Should You Compare Car Insurance Quotes Using Insurancey?

If you are on a quest to secure yourself solid insurance coverage, you need a comparison site that can provide you with a good view of all the potential policies available to you. And there are a number of positive aspects about Insurancey that are commendable and highlight why it stands above its competitors.

Free service: Finding and securing an affordable insurance rate with a wide level of coverage can often turn out to be quite tricky to achieve. With so many auto insurers having varying methods of assessing a consumer's insurance profile, Insurancey is a good resource to rely on since it doesn't charge consumers anything to use their service.

In other words, you can have instant access to some of the most affordable insurance rates in your area with coverage that completely fits your needs without having to make any initial financial commitment.

No spam: As we mentioned before, Insurancey does not use a lead-generation business model, which typically involves collecting consumer information to sell to insurance providers.

The company's revenue stems from successfully pairing potential car owners with auto insurance providers within their network. As such, you can rest assured that your information will only be used in line with what it was intended for. There is no risk of being spammed with promotional calls, texts, or emails.

Independent service: Some comparison services are sponsored by specific insurance providers to show you their lowest possible rates while unfairly displaying the most expensive policies of other companies. However, Insurancey is an independent agent that has no ties to any one company in particular.

This means that you can remain confident the auto insurance quotes presented to you via their site remain both accurate, unbiased and completely in line with the information you provided.

Speedy results: Insurancey provides car owners with a completely hassle-free experience that enables them to compare auto insurance quotes almost instantly with no need for excess paperwork or lengthy wait times.

All that is needed is to submit an online form with a few basic pieces of information, and you will be able to compare multiple quotes from a number of top insurers on a single page. Once you find the ideal car insurance provider, you will be directed to their site, where you can proceed and complete purchasing the policy online.

Wide insurance network: Insurancey is partnered with dozens of licensed auto insurance providers in the US, both large and small. As such, the platform is able to provide consumers with access to numerous insurance packages to choose from.

Furthermore, since all those car insurance companies use their own specific computations to produce quotes, having a large pool to select from increases the likelihood of finding a policy that best suits your needs and budget.

What Sorts of Coverage Are Available With an Auto Insurance Package?

Auto policies will usually end up consisting of a wide variety of coverages. And depending on where you live, some of these coverages may be legally required by your state, while others may be optional. Some of the most common types of coverage offered include;

#1. Liability coverage

Liability coverage is designed to protect other parties when you are at fault in an accident. It usually encapsulates two different types of coverage: bodily injury and property damage. The former covers expenses that are a result of injuries sustained in an accident, while the latter covers any damaged property. Most states legally require drivers to have some form of liability coverage.

#2. Collision coverage

Collision coverage essentially handles any repairs to your car should you turn out to have been responsible for an accident or collision. It is optional insurance coverage, but it is often a good idea to have it included in your policy whenever possible. After all, no matter how good of a driver you are, there is always a chance that you may still find yourself involved in an accident or collision.

#3. Medical Payments Coverage

This type of car insurance coverage is meant to help pay for any medical costs that are a result of any injuries that you or your passengers may have experienced, regardless of who is at fault. The coverage can also be applicable if you were a passenger or pedestrian that was injured in a car accident. It is not available in every state, while in other states it is considered optional.

#4. Personal Injury Protection (PIP)

Similar to medical payments coverage, PIP covers any medical expenses that you or your passengers may have experienced after an accident. However, the difference is that PIP also includes coverage for other expenses that result after the accident, such as lost income, funeral costs, or childcare expenses. This form of coverage is optional in most states but required in a few others, such as New York and Michigan.

#5. Comprehensive coverage

Comprehensive coverage essentially handles all physical damage to your vehicle that is not covered by collisions, such as theft, vandalism, and damage from naturally occurring disasters. And while most people assume that it covers everything, comprehensive coverage does not cover personal items such as the loss of your wallet or phone.

#6. Uninsured Insurance & Underinsured Motorist Coverage

Uninsured motorist insurance is meant to help cover the costs of your medical and car repair bills should you end up in a collision with an uninsured driver or even in a hit-and-run accident.

On the other hand, underinsured motorist coverage is applicable in cases where the driver you collided with lacks sufficient coverage to pay for the damage they may have caused. This form of coverage effectively helps to pay off the remaining balance of any medical bills or other expenses that may have resulted from the accident.

FAQs

1. What Should I Think About Before Getting Car Insurance Quotes?

You should take some time to review your budget, as well as the type of coverage that you are looking to purchase. Wider car insurance coverage tends to mean having to pay higher monthly premiums.

As such, you should primarily focus on coverage that fits well with your driving habits, what you use your vehicle for, your current driving environment, as well as the distances that you frequently travel.

You should also remember that while larger insurance providers charge higher rates, they often have more to offer than smaller insurers through services such as roadside assistance, towing, etc.

2. What Car Brands Are Insurancey Acceptable?

Insurancey is an online insurance marketplace, which means our platform accpet all car brands. You can feel free to search for insurance quotes for any type of vehicle, be it a BMW, Mercedes Benz, Toyota, Ford, Honda, etc. However, you should keep in mind that the car models can also affect the insurance quote that you receive, as some car brands tend to pose a higher historical risk of theft, injury, or damage compared to others.

3. Who Can Benefit From Insurancey?

If you happen to be under the age of 25, then Insurancey can be of big help, as most insurance providers tend to consider young, inexperienced drivers as high-risk.

If you have also been convicted of DUI or DWI in the past, then most insurers will also consider you to be a high-risk client. Also, if you own a high-end luxury sports car, this can make it difficult to secure affordable insurance premiums, as there is usually a higher risk of accidents, collisions, or even theft.

In such cases, comparing quotes using Insurancey can really pay off. You will be able to review the multitude of options available to you until you find the ideal insurance rate and level of coverage.

4. What Could Influence the Price of My Auto Insurance?

Car insurance providers use their own complex algorithms and determinants to calculate insurance rates. As a result, it is not uncommon to find yourself getting quotes from companies that end up varying dramatically.

The type of vehicle you own is a major factor that can affect how high or low your premiums will be. For instance, luxury cars pose a risk of theft, so your insurance provider will charge you more to cover them.

They will also take into consideration your age or driving experience, your driving history, as well as your place of residence since each state comes with its own local driving laws and regulations.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.