A thorough policy review and comparison can go a long way toward reducing the risks that come with an auto insurance policy. Unfortunately, this process is quite hectic and time-consuming when done manually.

Using an instant car insurance search engine simplifies the process by providing quotes and other important information of different car insurance companies in an easily understandable format. This significantly reduces fraud, the time needed for optimal decision-making, mispricing, and other multiple inconveniences when taking out car insurance coverage.

What is Insurancely?

Insurancely is an online tool to compare car insurance quotes. This website allows you to shop for car insurance coverages by ZIP code, providing precise estimates on how much different insurance companies charge.

Factors like your ZIP code's population, crime rates, state coverage requirements, income rate, type of vehicle, and credit score will affect the car insurance quotes you get on Insurancely.

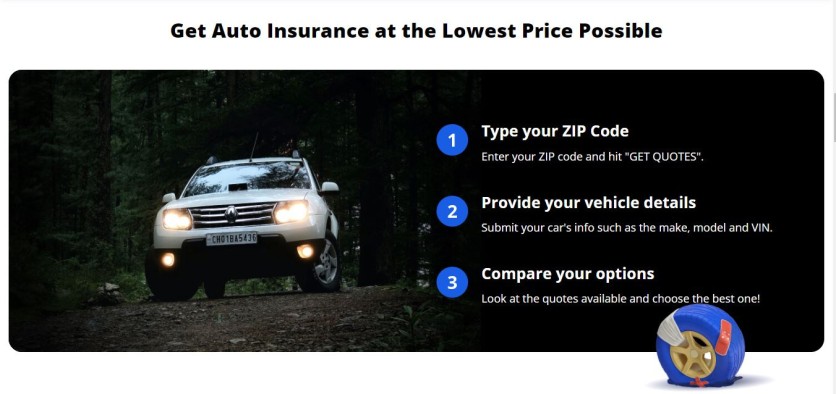

How to Search for Car Insurance Using Insurancely

Conducting an auto insurance search on Insurancely doesn't require any special skills. Simply enter your zip code, and the tool will guide you through the rest of the process to obtain an unbiased search. Here's how you can use Insurancely to get quotes for auto insurance in your area that fit your needs:

1. Enter your ZIP code

Navigate to the Insurancely official website, type your ZIP code in the search box, and click "Get Quotes."

2. Submit your car's details

After hitting the "Get Quotes" button, you'll be directed to another page where you'll provide your vehicle's details for a more refined and quick search. This helps the platform scan many sources to find available policies depending on your car type and area code.

3. Compare provided options

You can find multiple car quotes with a single search on Insurancely. Compare them before selecting one that suits your needs, preferences, and budget.

If you have more questions about car insurance quotes,you could find the answers on this page from Insurancely.

Why We Appreciate Insurancely.ai

Insurancely.ai stands out from the countless car insurance comparison tools, and it's easy to see why. Its all-inclusiveness and high efficiency explain its reliability. Some of the reasons that make this service unique include the following:

1. Completely free service

You can use Insurancely.ai to find and compare car insurance quotes from several firms entirely for free, including top-notch companies. This feature lets people on a tight budget choose from a variety of options based on the type, model, or condition of their car.

2. Unbiased car insurance search

Insurancely helps you find and compare car insurance quotes based solely on customer rankings and prices.

3. Guaranteed privacy

Insurancely.ai uses up-to-date encryption to protect users' privacy and promises not to leak or share users' information with third parties or send them spam or other annoying messages.

4. High-quality auto insurance quotes

All the quotes from Insurancely.ai are from highly reputable and reliable companies. This feature ensures transparency and dependability for anyone seeking affordable and suitable car quotes.

5. Discover more insurance companies

Insurancely.ai can help you discover and connect with multiple trustworthy insurance providers you didn't even know about. You'll be linked with insurers through links on every quote you receive, allowing you to connect with them, make a thorough comparison, and choose wisely.

Pros and Cons

Pros:

1. Insurancely.ai connects you with car insurance companies that offer affordable quotes, even if you're an inexperienced driver.

2. Drivers with bad credit histories can also compare and find better quotes with Insurancely.ai

3. Comparing auto insurance quotes on Insurancely.ai helps drivers save money.

Cons:

1. Quotes you find with insurancely.ai may be accurate, but they're only price estimates and do not represent the actual or final price from the insurance companies.

Key Factors That Can Affect The Car Insurance Rates You Find With Insurancely.ai

Several factors influence the rates of car insurance quotes you may receive. Even if they live in the same zip code and have similar car models and types, different people may receive different quotes. The main reasons for this are:

1. Age difference

Your age matters a lot when insurers determine the most appropriate car insurance policy for you. Due to their lack of experience, younger drivers are more likely to get higher quotes than older drivers.

To insurers, less experience comes with more risks, which they have to protect themselves from. For example, inexperienced drivers are prone to reckless driving or causing accidents.

2. Residence area/location

Drivers are also susceptible to varying risk factors based on their residential areas. These risks include high accident rates, vandalism, and car theft. When determining vehicle insurance rates, insurance companies take such factors into account heavily, and drivers in high-risk areas should expect higher quotes.

3. Vehicle details

Details such as your car model and age significantly influence the insurance rate you receive from different companies. If your vehicle is old, your insurers will likely offer you a high insurance rate since they usually consider such cars to have more mechanical issues.

4. Credit history

A good credit history gives you a higher chance of finding affordable and better insurance rates. If you're planning to get a car insurance policy, it's best to work on your credit score to avoid missing out on good deals.

5. Driving history

Insurance firms can refuse to insure you if you have a bad driving record. For instance, insurance companies regard drivers with more accident records and speeding tickets as high risk and thus offer them higher insurance premiums or even deny them one.

FAQs

1. Is Insurancely.ai legit?

Yes. Insurancely.ai is a legitimate tool developed to help drivers find and compare car insurance quotes. It simply searches for insurance quotes and compiles them on one page for users to compare.

2. How does the ZIP code affect auto insurance rates?

Insurance companies usually check and compare the claim histories in specific zip codes before setting rates. Areas with a record of multiple risk factors like vandalism, fraud, theft, and natural disasters can mean high rates.

Also, your insurance rate can be higher if you're living in an urban or highly populated area compared to a rural or less populated area.

Verdict

Insurancely is a reliable and advanced tool for finding and comparing auto insurance quotes. It also has a number of benefits that you can use to your advantage.

Its access to an extensive database and unbiased data search will help you find and compare unlimited car insurance policies and connect with high-end insurance firms in your ZIP code without hassle.

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.