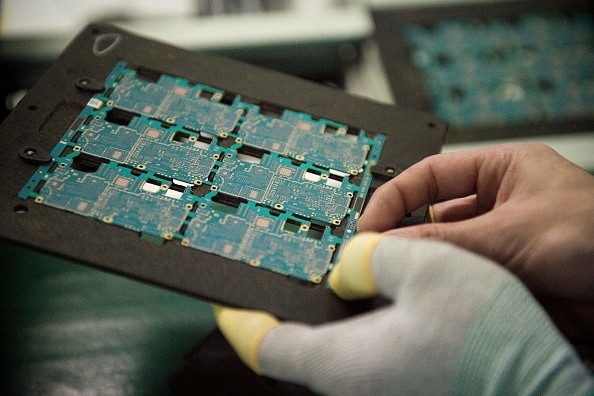

Economic headwinds have hammered global chip demand for the third consecutive month. Recent industry data shows that it resulted in a 21.2% year-over-year decline in China's semiconductor sales to $13.4 billion in November 2022, South China Morning Post (SCMP) reports.

Decline on China Chip Sales

Based on the report by the Semiconductor Industry Association (SIA), a Washington-based trade body that represents 99% of the US chip industry, China's loss was the largest percentage reduction among the world's main markets for integrated circuits (ICs).

SIA data also indicated that this was the steepest annual drop in sales for China since the country's monthly sales in 2022 began to fall in July. With 2021 sales of $192.5 billion, China's semiconductor industry surpassed all others.

Last November, global sales of chips were $45.48 billion, down 9.2% from $50.09 billion in the same month of 2021. As of September last year, worldwide demand had already gone down, with annual sales down 3% to $47 billion.

SIA's CEO, John Neuffer, cited market cyclicality and macroeconomic challenges for the sales decline of semiconductors worldwide in November 2022.

According to him, sales in China dropped considerably on a year-on-year basis, while sales in the Americas were up from November of the previous year.

Related Story : Chip War: China Plans to Turn Shenzhen Into a Semiconductor and Electronics Powerhouse

The Downward Trend

Recent SIA chip sales figures confirm that manufacturing bottlenecks, an intensifying tech war with the US, and economic pressures negatively impact China's demand for semiconductors.

According to statistics from China's customs authorities, the 11 months ending on Nov. 30 of last year saw the biggest losses in chip imports in the country's history.

A similar downward trend can be seen in China's IC exports, which dropped 11.7% year-on-year to 250.5 billion units in the same time frame.

Even though China's annual Singles' Day shopping celebration usually causes November to be the busiest month for electronics sales, last year was an exception due to the lackluster demand.

In a study by the China Academy of Information and Communications Technology, an academic research agency under the Ministry of Industry and Information Technology, smartphone sales dropped 36% year on year to 22.2 million units last November.

The biggest and most sophisticated contract chip producer in mainland China, Semiconductor Manufacturing International Corp (SMIC), forecasted last November that weak demand for consumer electronics would hurt the company's prospects in the first half of this year.

US-China Chip War

The US government's export limitations implemented last year have further increased the amount of stress placed on China's semiconductor business.

Concerned that Beijing was utilizing commercial technology to modernize its military, Washington put 36 Chinese companies on its trade blacklist last month, including flash memory chip producer Yangtze Memory Technologies Co.

This follows the previous move by the Biden administration in October 2022, which included new measures to limit China's access to cutting-edge semiconductors.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.