The financial world is progressing as we speak. Today, financial data APIs are changing the game for financial analysis. These financial data platforms are built intelligently, benefiting anyone in the said industry. Professionals, in return, can access better insights and financial decisions. To prove how financial services peaked at their prime, here are our top 5 best financial data APIs this 2022.

What Is Financial Data API?

Financial data APIs refer to a platform that deals with facilitating transactions, information access, payments, and other related activities. So why use API? It's because it improves everything you could expect from a financial data management platform. It encompasses better collaboration between partners, data gathering in stock markets, interaction with partners, customer experience, etc.

What Is the Best Finance API?

To know which financial data API suits you best, check the different kinds out there. There's one for a brokerage to gain information on stock and cryptocurrency markets to draw better trading conclusions. There are also those for banking so people can easily connect the financial data platform to their bank account for a modernized banking experience.

Now, the goal here is to get a hold of financial information at your disposal. The best financial data platform must let you access financial data, obviously. But it should also integrate with other financial applications and the data that come with them. Most importantly, it should be reliable enough to be used in the field of finance.

#1 Financial Modeling Prep

Several financial data APIs may offer insightful data, but a majority still require one to look elsewhere when it comes to accessing data on stocks and other complexities. Here's where Financial Modeling Prep differs and prospers. Financial Modeling Prep is a one-stop financial data platform built for a thorough fundamental analysis of data.

This financial data API brings productivity and accuracy to financial analysts. They can access all data in numbers and language in financial statements, even those suppressed in the footnotes.

It offers an array of financial data at yearly, quarterly, and daily intervals. It has a pretty extensive documentation section that deals with detailed steps on how to pull data using Python, Scala, R swift, and other languages. You can also retrieve financial data, including a balanced sheet, income statement data, etc.

Key Features

- Stock value: Financial Modeling Prep provides discounted cash flow metrics that can be calculated at specific points in time (daily, quarterly, or annually). It helps determine whether a stock is under or overvalued. You can check this out in their stock API. Another thing — the API supports more than 40,000 stocks in different exchanges.

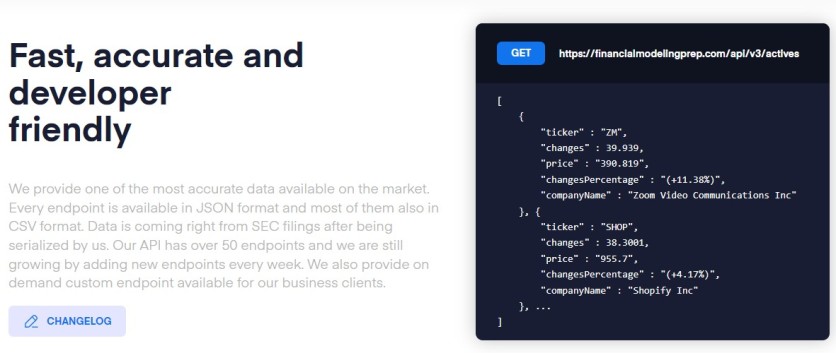

- Fast, accurate, and developer-friendly: Financial Modeling may be built by experts in the field of finance, but it's also made for developers. In fact, you can learn more about their stock price API regardless if you are adept at being a developer or not.

Aside from that, this financial data platform also boasts data accuracy, which topples other platforms in the market, while the majority is in CSV format. Data comes straight from SEC filings, serialized by people working behind the curtains. Going back to being developer-friendly, every endpoint is made available in JSON format. The API has 50+ endpoints and continuously welcomes another one every week. You can also get an on-demand custom endpoint if you wish.

- Credible data source: Every gathered financial data came from trusted sources. These sources are SEC, FRED, CFTC, or Tiingo Inc. Despite coming from expert sources, Financial Modeling Prep is still actively working on improving and maintaining quality data.

- Quality data: To make informed decisions, it guarantees quality data. As a matter of fact, you can also get various economic data such as inflation rates, GDP, economic calendar, and more.

In general, Financial Modeling Prep API provides real-time stock prices. Other offerings include setting forth available company financial statements, major index prices, historical stock data, real-time forex rates, and even cryptocurrencies. It can also report in daily, quarterly or annual format for at least 30 years back in history.

Pros

- Data quality and depth

- Wide market coverage

- Unique data set with alternative data (price targets / US number of employees / Ownership datasets)

- Backed up by a dedicated customer service

- Provides real-time stock price

- Can report in a daily, quarter, or annual format

- Can report stock from 30 years back

- Offers personal, professional, and enterprise pricing

Cons

- Uptime differs from every pricing

For a general overview, we can attest that Financial Modeling Prep is a solid one-stop-shop solution for all stock-related data. You can easily trim down the time, costs, and effort spent in finding necessary financial data with its features. You can also take advantage of their rich series of important metrics. Doing so lets you or a financial analyst assess stocks in-depth.

But aside from stock, you also get more financial-related services accompanied by features that make it easy to take care of. Do you think you're in for a quality data collection? Register now and get your hands on every financial data relevant to your personal or enterprise success.

#2 Intrinio Financial Data API

Intrinio puts forth every financial data you need. You can start your financial product building right away from market data, company fundamentals data, options data, or SEC data. Moreover, all these info at hand are not standing by themselves, too. All are powered by advanced data quality technology, which is then given through Intrinio's financial data API and other tools.

The financial data API provides historical, intraday, and end-of-day real-time data that you can utilize in any endeavor of your choice. You can even download on-point historical market data dating back from 5 up to 50 years. But at the end of the day, you may have a different view of what you're seeking.

Fortunately, there is a subscription-based model to figure out what exactly you're looking for in data. Besides that, Intrinio's offerings can also assist in shaping your investment strategies because of their variety. In fact, you can access data associated with diverse asset classes, analysis of financial statement information, estimates, forecasts, and ratings. At the same time, you also get a heap of industrial and economic data as well as those for holdings, metadata, and more.

Key Features and Advantages

- Supported by a dedicated customer service

- Functions as a single source for US stock price data APIs

- A secured platform to avoid financial worries

- Helps launch and grow your options trading through available reliable options data

- Real-time quality data for your financial product building

#3 Pluggy

Another competitive financial data API to close the gap between you and the data you need is Pluggy. You or your users' financial data is accessible to your financial analysts through a single API. With that, you can improve business operations and services for your customers. The edge with Pluggy is that you're free to do as you please with your gathered data, and they have the exact features to help you out, too.

When you think about finances, you often think about credit cards, fraud, costs, bills, payments, loans, etc. Whatever it is that you thought about, Pluggy has a single API that covers it all. You can develop decisive credit models, mitigate fraud, reduce costs, send payments easily, etc.

With this financial data platform, you don't just have real-time access to your clients' investment place among all brokerages and banks. You can also aggregate this information from available financial institutions. In that way, you can commit to personal financial management assistance.

Overall, Pluggy is one of the best choices to build everything in the field of finances. Expect an increase in conversion and a scalable business right away. Do all these by simply accessing financial data to offer better services and improve solutions and offers.

Key Features and Advantages

- Automatically categorizes customer accounts

- Data encryption and LGPD compliant

- Dashboard to see financial data in the easiest way possible

- Built by developers and intended for developers as well

#4 Validis

Successful businesses rely on financial analysts to view data. Validis does the same thing by providing a regulated view of your customers' financial data. This financial data platform is capable of handing out deeper insights and informed decisions.

Consequently, it automates a view to make the job a lot less complicated for analysts. Hence, this removes an insufferable amount of time spent gathering relevant data and carefully dissecting it.

Unlike other financial data APIs here, Validis is of great use for customers applying for loans. With a digitized way of gathering financial data and a simplified means of the overall facilitation, you can guarantee neat, consistent, and formatted data. But it's not only the customers who can experience this case. Financial analysts can also have an easier way of focusing on data and gathering value-driven insights.

Key Features and Advantages

- Validis drastically cuts cost and the time to decide by acquitting a standardized view of financial information just within a minute

- Lets you receive financial data in a standardized form regardless of the size, source, type, etc

- The financial data comes with an insightful dashboard to simplify all information

- Its Datashare feature automates the composition of valuable insights gathered from data

#5 Xignite

Xignite has been one of the most innovative financial data APIs over the years. It's designed with adequate coverage and usability to let you reach your investors. The quality of their data and their services allow you to maintain clients, and at the same time leading you to success. It's because Xignite's roster of expert developers built a Cloud API that seamlessly supplies financial data to consuming applications.

With Xignite, you can have a taste of robust and easy access to financial market data. After all, it has been setting standards for both usability and scalability for over 14 years. Because of its notable lengthy service, the width of coverage won't be left behind. Xignite covers real-time, historical, essential, and references data.

Even the entirety of asset classes, equities, crypto, FX, ETFs, options, bonds, futures, credit markets, and more are available. Another good thing about Xignite is that every API available includes unlimited usage. So, there is no need to purchase disordered packages as well as per-call charges.

Key Features and Advantages

- Gain institutional quality data from 250 leading data providers

- Has a global financial data API coverage for all classes of assets

- Multiple data types available, including real-time and historical data

- Scalable and robust so that you can use their services with no fuss

- Unlimited usage and different ways to receive data

Best API for Financial Data

Nothing can ever facilitate more straightforward financial data sharing for professionals and customers than financial data APIs. With a reliable and quality financial data platform, you can easily bridge the gap between you and every facet of the financial sector. The best API we can suggest is Financial Modeling Prep through its one-stop solutions. Other choices are Intrinio Financial Data API, Pluggy, Validis, and Xignite.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.