DeFi opens opportunities for gaining returns on crypto investments. Unfortunately, such opportunities are located on different chains and projects, their reliability is sometimes questionable, and diving into new ecosystems takes time users rarely have. So many individuals prefer HODLing and keeping all the assets in their wallets or not even entering the growing market. With the Neuron Fund, they can gain returns on their HODLed assets within the risk preferences they choose.

Neuron Fund is a decentralized fund leveraging liquidity, options, and trading strategies to deliver attractive risk-adjusted performance on crypto and stablecoins.

Neuron Fund makes quality investment fund services available for those who keep their wealth in the blockchain. The project starts with several different investment venues that generate a return on the client's assets. The ultimate goal is to make fund services state-independent, decentralized and inclusive. For that matter, the project has recently attracted $0.5 million in private funding from a range of investors.

Option pools: auto-trade options to gain yield with selling options

An option is a derivative product that gives a right to buy/sell a specific underlying asset at an agreed price on a certain date. As with other derivatives, an option is security derived from another security, which can be a currency, a commodity, a rate, etc. Options are backed by collateral of the existing securities - in the case of Neuron, these are crypto assets, such as WBTC, ETH, stablecoins, and UNI, LINK, AAVE shortly.

Neuron Fund collaborates with several DeFi option protocols such as Opyn, Hegic, and Lyra and is open to new integrations to create attractive option-based products.

The project will also host a 24-hours long token auction on August 31, offering users an opportunity to buy NEUR tokens with a beneficial discount.

Secure liquidity pools

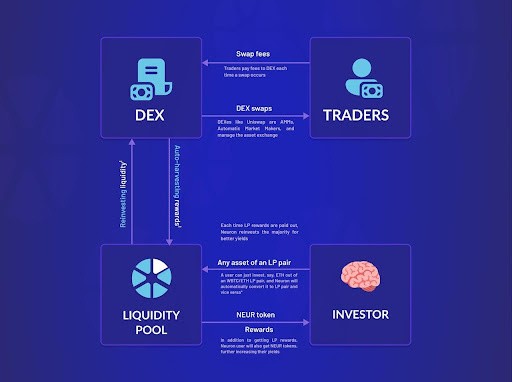

Liquidity Pools route assets in the form of liquidity pairs to exchange protocols such as Sushiswap, Quickswap, or Curve. All steps are automated to save a user's time: liquidity pools collect investors' funds and reinvest them in various yield-producing products or services through interacting with their protocols. A short primer on how LP pools work:

With Neuron, users can now enter the pool with just one click and use just one asset they own (while two or more are needed to add liquidity). Based on Ethereum and Polygon blockchains, Neuron Fund can be considered the first decentralized fund that offers a range of investment pools both friendly for a DeFi-naive person and helpful for an experienced DeFi user.

Holding protocol token veNEUR entitles a user to the share of the fund's revenue. Unlike other protocols, which usually collect fees to the benefit of developers or managers, we redistribute management and performance fees among veNEUR token holders. NEUR for veNEUR exchange is a vesting and yield system based on the innovative Curve's veCRV mechanism

Vote-locking

Users may vote-lock their NEURs for up to 4 years for veNEUR. By doing so, users become shareholders in Neuron Fund, who can influence protocol's development and gain proportional revenue.

Although this may seem similar to a time-locking mechanism, where users can't withdraw their staked tokens before the lock expires, several features make this an advantageous way to propel Neuron Fund, and hence DeFi fund industry, forward:

● user's veNEUR stake is decreasing linearly - NEUR linearly unlocking and allowing to increase yields further;

● vote-locking opens the way to receiving a share of protocol's revenue as well as directly increasing the yields by applying a multiplier to user's NEUR returns in investment pools;

● protocol's tokenomics encourages early adopters yet creates long-term fundamentals.

Neuron Fund follows a rigorous approach to keeping every client's assets safe: funds are secured by a diverse set of audits along with improved pools' hacker protection by hosting an ongoing $25,000 bug bounty program.

The project is launching in beta on September 1, 2021.

Neuron pre-IDO Auction will start on August 31, 2:00 pm UTC, and last for 24 hours, followed by the NEUR listing on Sushiswap and beta-launch on September 1 at the same time. For 24 hours, you will be able to get the discount on NEUR tokens on the project's auction page. Add the event to your Google Calendar and don't miss the early-adopter bonus!

For more information about Neuron Fund, please visit our website: Neuron Fund

Social:

Twitter: https://twitter.com/neuronfund

Telegram: https://t.me/neuronfund

Discord: https://discord.gg/SFasvmAwSr

Medium: https://medium.com/neuron-fund

![Apple Watch Series 10 [GPS 42mm]](https://d.techtimes.com/en/full/453899/apple-watch-series-10-gps-42mm.jpg?w=184&h=103&f=9fb3c2ea2db928c663d1d2eadbcb3e52)