Kikoff recently raised $30M on top of its $12.5M to help users gain credit history to build good credit.

Kikoff's On-Going History

Kikoff is a personal finance platform that has recently acquired $30M in a Series B round. Previously the capital was about $12M raised in Series A rounds spearheaded by Lightspeed Venture Partners, while Portage Ventures led Series B. Among the ones included are GGV, Coatue and Core Innovation Capital, and Lightspeed.

Not only them, but NBA star Steph Curry, former CFO of the U.S. Department of Treasury, Teresa Ressel, and Wex CEO Melissa Smith.

The company was founded by CEO Cynthia Chen and CTO Christopher Chong, based in San Francisco during the fourth quarter of 2019. The duo started the company to help people who do not have a credit history create one and nurture it to build better credit.

Inspired by their upbringing, the duo was raised from a "low to moderate income" group of families. So they planned the vision all out to help people with similar economic upbringings. Chen grew up in Beijing, China, before moving to the United States for a college education via scholarship. In the U.S., he saw the changes of having little to no money when his parents needed to borrow money from family and friends.

Kikoff's Financial Numbers

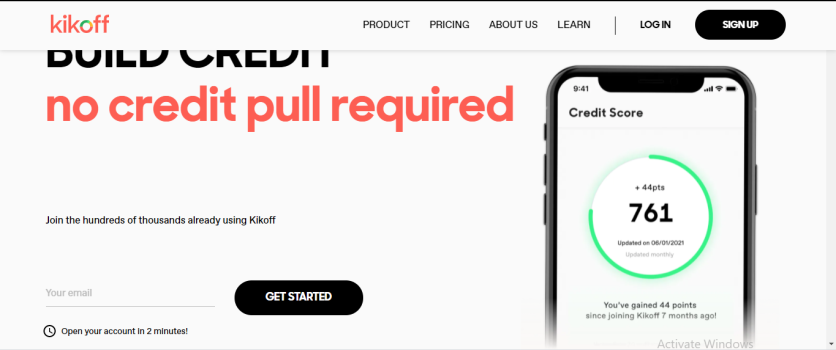

The company has yet to release the hard line figures of how much they really spend, but Chen said that Kikoff has more than hundreds of thousands of customers now since it came out from the beta version for half a year. The product that Kikoff is promoting is called "Kikoff Credit Account," and it's just the first of many planned offerings that all aim to improve financial stability and, ultimately, security for their users.

"There are many Americans who don't come from affluent families and have tons of student loan debt ... For them and so many others, we wanted to create a better way to build good credit than existing offers in the market."

Target Market

Besides the people who do not have a credit history, the duo's vast majority of users come from the GenZ and Millenials who need to build better credit than most. Another goal of the two is to give the users a more in-depth financial literacy, among other things.

The way Kikoff works is that users can use their credit in a built-in online store to get things such as e-books that cover topics about finance and other related issues regarding saving and investing money wisely. Basically, the e-store tells you how to take care of your finances and even learn how to code in Python.

Chen told TechCrunch "When a customer purchases something from our store, that item is going to help that person improve his or her financial habits."

Read More : Messaging Platform Ably Raises $70 Million Worth of Funds -- Here's What the Money is For

This article is owned by Tech Times

Written by Alec G.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.