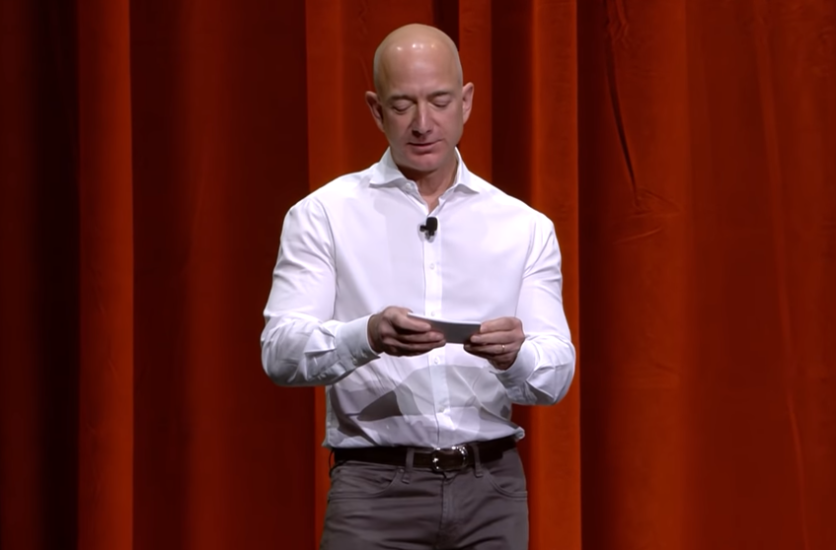

Amazon CEO and founder Jeff Bezos recently said that he is actually welcome to the rise in corporate taxes in order to cover the "bold investments" that go into infrastructure in the US. The government singled out the tech giant for actually failing to pay federal income tax while proposing taxing businesses and the rich to cover their large $2.25 trillion infrastructure plan.

Amazon CEO Addresses Tax Rate Increase

According to Telegram, Amazon has been criticized countless times for alleged efforts to tax cutting. Politicians are now debating about how to pay for the government's ambitious overhaul, which would include investments in EV, revamping water systems, and also improving public transport.

Mr. Bezos noted his support in making bold investments on the American infrastructure. Both the Republicans and Democrats have reportedly supported infrastructure some time in the past, considering it as the "right time" to work together to make this happen. Mr. Bezos also noted that he recognizes the fact that this investment will still require concessions coming from all sides.

Amazon's 'Various Loopholes'

Mr. Bezos also noted that the company looks forward to Congress and the Administration coming together to find the right balanced solution that would maintain or even enhance the competitiveness of the United States. The government has accused Amazon of actually being included as one of the many Fortune 500 companies using "various loopholes" by not paying federal income tax.

This contrasts with the middle class families that would be paying 20% tax rates and have no way of slashing their tax bills. Amazon has also been criticized in the past for the total amount of tax that it pays in the UK. This is thanks to the complicated but still legal accounting structures. It had seen a 51% increase in sales in Britain last year due to the massive switch in online buying due to people being banned from visiting physical shops.

Read Also: Amazon Drivers Forced to Use Biometric Monitoring or Else Lose Their Jobs: Cameras to Monitor Fatigue and Unsafe Driving

Amazon Massive Profits

Amazon had only paid around $20 million in corporate tax despite raking almost $27 billion in revenue in less than one thousandth of its total turnover. Chancellor Rishi Sunak is now also hoping to agree to a brand-new international "Amazon tax" along with other nations which would impose taxes on online companies' profits. This would make it a priority for the important June G7 meeting over at Cornwall.

Mr. Sunak also said some time last month that one of his priorities in the G7 this 2021, which has already been started, is to attempt and get international agreement on a brand new way to tax these particular companies. He noted that he spends a lot of time talking to his finance minister colleagues coming from all around the world regarding the particular issue. The official statement by Jeff Bezos was uploaded to Twitter on the official Amazon account.

A message from Jeff Bezos. https://t.co/ZAcpnaRu6z pic.twitter.com/81AkgVyQke

— Amazon News (@amazonnews) April 6, 2021

Related Article: Tesla Tries to Raise Taxes on Gas-Powered Vehicles by Lobbying with the UK Government

This article is owned by Tech Times

Written by Urian Buenconsejo