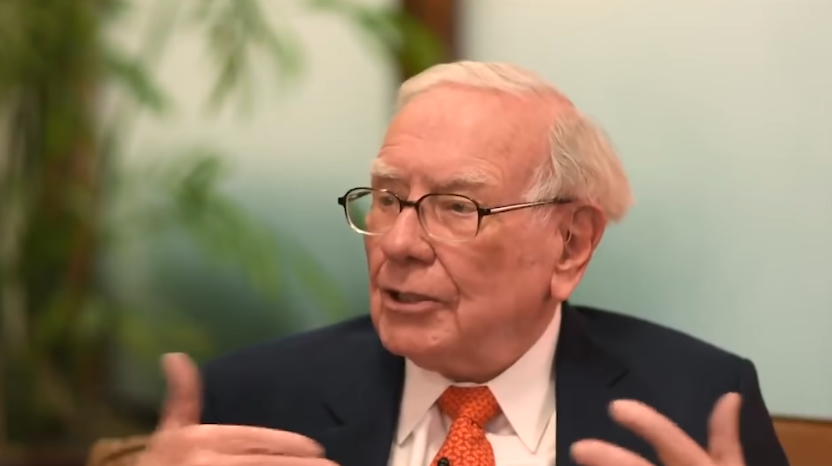

The shares of the popular Verizon Communications or VZ via the NYSE has climbed up as high as 5% this Wednesday shortly after Warren Buffett's Berkshire Hathaway or BRK.A BRK.B has just disclosed the company's new stake in Verizon. Warren Buffett's popular investment holding company has just filed its very own quarterly form 13F report that shows that it now holds over a whoppoing 146.7 million shares. As of 12:45PM EST, the shares went bullish reaching a 4.6% high.

Who owns the most shares of Verizon?

Just a few months ago, when Berkshire Hathaway had just filed its previous 13F, it actually noted that the regulatory filing had omitted some actually confidential information just after getting certain permission coming from the SEC or Securities and Exchange Commission. The agency can reportedly allow the institutional investors to be able to file confidentially if the whole disclosure has the potential to actually move the market and an investor would still be in the process of accumulating this particular position.

As of the moment, the Vanguard Group is still the owner of the most Verizon shares with a whopping 7.43% stake in the company with a whopping 307,502,472 shares in total according to Money.CNN. Buffett is most widely followed by a number of investors around the world. The market closely watching his activities, particularly when it all boils down to his brand new established positions, would be quite common.

What is the current dividend for Verizon stock?

The confidential filing triggered some considerable speculation during the recent months and investors are now aware that the popular telecommunications company was actually one of the picks. Berkshire Hathaway also reportedly filed an amended 13F for the upcoming Q3 which actually unveiled all of the confidential information. It was noted by Verizon that Buffett was actually buying stakes in the giant oil Chevron and also consulting firm Marsh & McLennan during the previous Q3.

Berkshire Hathaway was reportedly holding a whopping 58.3 million Verizon shares during the end of Q3. This means that the company had bought around a whopping 88.4 million shares just during the Q4 period. According to the story by Fool.com, it seems like Verizon really fits the type of value stock that Warren Buffett prefers. Big Red trades done at low valuation while also providing a generous 4.6% dividend yield that is funded by consistent cash flows fits the profile of Warren Buffett.

Read Also: Trading for a Living: Psychology

Is Verizon good stock to buy?

The investment legends as well as Motley Fool co-founders Tom and David Gardner had just reportedly revealed what their top 10 best stocks are for investors as of the moment. Verizon, however, wasn't really one of them. According to them, they think there are 10 other stocks considered as better buys than Verizon.

Related Article: Jeff Bezos Regains World's Richest Man Title: 10 Things You Don't Know About Him

This article is owned by Tech Times

Written by Urian Buenconsejo