As Horizon Protocol is getting ready for its mainnet release, the spotlight is on its latest milestone: the Futures Testnet going live. This crucial development phase introduces the Futures Account Management System, a game-changer empowering traders with advanced functionalities like conditional orders, cross-market margin management, and streamlined command execution.

(Photo : Horizon Protocol)

Experience Horizon Futures Testnet V2

Today the interested traders can already start their new trading experience with the Horizon Futures Testnet V2. Those who want to play and have fun with the Testnet features, would just switch their wallets to Arbitrum Testnet and explore the future of decentralized derivatives trading.

Futures Account Management System (FAMS): Updating Trading Rules

FAMS is at the heart of the update. It is a middle-layer smart contract system built atop Horizon Protocol's Perpetual Futures contracts. Drawing inspiration from Uniswap's Universal Router, FAMS allows for executing multiple commands in a single transaction, enhancing trader experience and time efficiency. With FAMS, traders can seamlessly manage margins across various markets and execute complex orders effortlessly.

Integrating Gelato's automated task execution system adds another dimension to Horizon Futures, enabling the automatic execution of conditional orders based on predefined triggers set by traders.

Exciting New Features Unveiled:

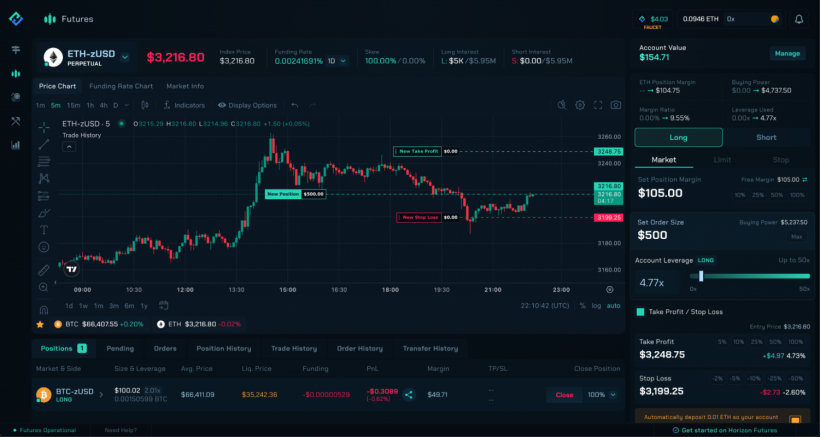

Limit Orders

Set your buy parameters, including amount, price, and leverage, and let the system fill your order when the futures price hits your specified limit.

Stop Orders

Define your stop trigger price and order size, ensuring automatic execution when the trigger is reached and safeguarding your positions.

Take Profit / Stop Loss Orders

Manage risk efficiently by setting profit and loss targets. Simply toggle the Take Profit / Stop Loss option, input your targets, and track expected outcomes effortlessly.

(Photo : Horizon Protocol)

Cross Market Margin Management

Gain a comprehensive overview of your account across multiple markets, facilitating better margin management and informed decision-making.

Automation Simplified

Gelato Task Keeper facilitates the execution of conditional limit and stop orders, eliminating manual intervention. Ensure your keeper is funded to enjoy automated order execution seamlessly.

What's on the Horizon?

Horizon Protocol recently celebrated its three-year anniversary with a special merchandise giveaway. To further encourage participation, a new trading competition with a 2,000 PYTH reward pool awaits traders from May 6 to May 27, 2024.

Unlocking the Potential of DeFi Derivatives

Horizon Protocol is moving ahead in the space of decentralized derivatives trading, offering access to real-world assets through synthetic assets. With Horizon Protocol, users can access swaps and perpetual futures of real-world assets, including fiat (USD, EUR, JPY, etc.) and commodities (gold, silver, etc.). With a focus on peer-to-pool trading, low fees, deep liquidity, and zero slippage, Horizon Protocol transforms the essence of DeFi derivatives trading. Emphasizing intuitive UI/UX and educational resources, Horizon Protocol empowers its community to harness the power of decentralized finance derivatives.

Final Thoughts

Horizon Protocol's Futures Testnet debuts with the Futures Account Management System, enabling advanced trading functionalities like limit and stop orders. Integration with Gelato automates order execution. Traders can now manage margins across markets and access comprehensive account overviews. The Testnet invites users to explore its features, while recent milestones include a three-year anniversary celebration and a forthcoming trading competition.

* This is a contributed article and this content does not necessarily represent the views of techtimes.com